Boards & Governance

Board Monitor Australia and New Zealand 2024: Navigating shifting sands

For many years, Heidrick & Struggles has been tracking the trends that have shaped the global governance arena including important long-term changes in board independence, diversity, financial oversight, risk management, and in the shareholder base the directors serve.

More recently, we have been helping our clients understand the expanding environment in which they are operating. How is the role of business in society changing? What are the implications for directors? What does the future hold?

Clarity has been hard to find as directors struggle to draw reasonable boundaries and consider their responsibilities in the midst of a rolling global pandemic, geopolitical uncertainty and conflict, emerging technologies, cybersecurity concerns, and a long list of social and environmental concerns. While there are important industry and regional differences—indeed, differences from one company to another, most accept that the role of the board is expanding. More is at stake. More is uncertain. And more is expected now of directors.

While this expanding role creates added pressures, it is also creating opportunity. New approaches are emerging for boards and individual directors who see promise in this shifting landscape. In what follows, we draw on the results of two recent surveys of CEOs and directors around the world, and our experience, to describe how directors and CEOs are answering six questions that are reshaping the boardroom.

Six questions reshaping the boardroom

- Who is influencing the board agenda today—and are board members happy with that?

- Where does the board spend its time—and are those the right places?

- How are boards addressing the widening risk environment?

- Are boards more operationally involved?

- How should boards engage with the workforce?

- How are boards thinking about diversity today?

Who is influencing the board agenda—and are board members happy with that?

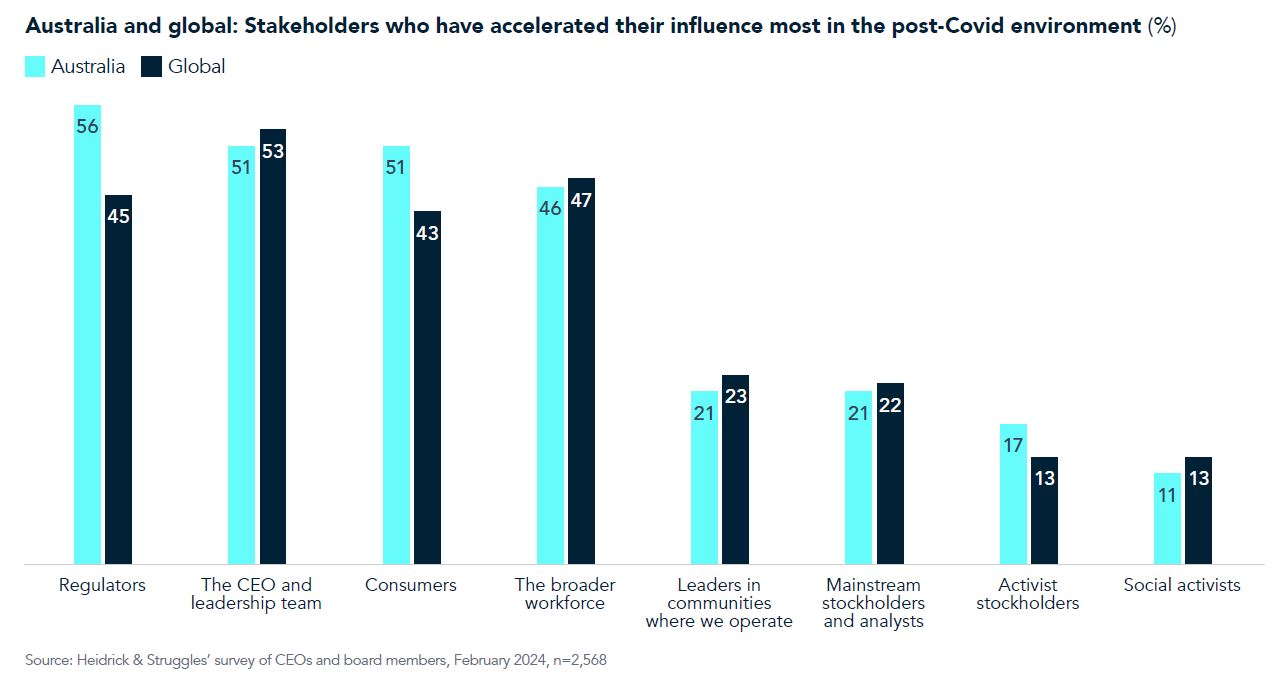

To better understand the relative influence of stakeholders today, we asked directors and CEOs to stipulate which stakeholders have accelerated their influence most in the post-Covid environment. Globally, they report that the CEO and leadership team, the broader workforce, regulators, and consumers have increased their influence more than others. In Australia, regulators top the list, with the CEO and leadership team and consumers tied in second. Although the broader workforce is only fourth in terms of increased influence on the board, engaging effectively with the workforce is foundational to organizational success and was a priority for boards before Covid.

Where does the board spend its time—and are those the right places?

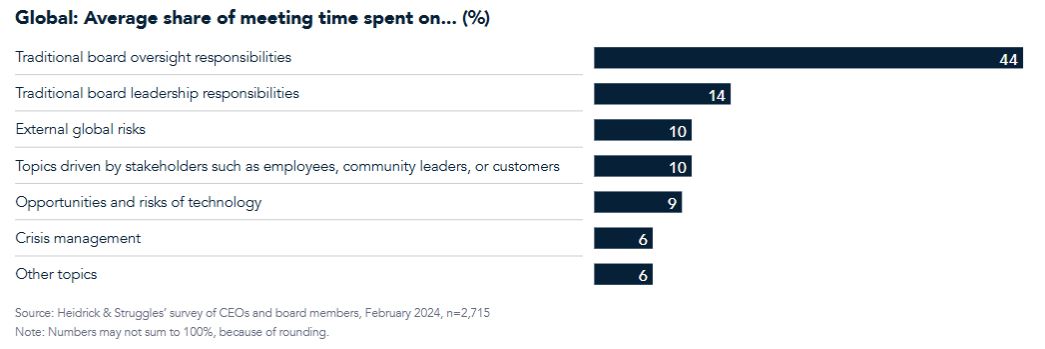

There is broad agreement globally, among both CEOs and directors, that the board meeting agenda remains primarily focused on “traditional board oversight responsibilities” (financial performance and risk, stockholder concerns, and strategy reviews, for example) and “traditional board leadership responsibilities” (CEO succession planning and leadership performance and compensation, for example). Together, these categories take up nearly 60% of boards’ time. External global risks, the opportunities and risks associated with technology (AI and cyber) and other stakeholder issues capture about 10% each in the balance of the meeting schedule. Crisis management and other topics round out the balance.

Globally, more respondents report spending more time on emerging technologies/AI and cybersecurity compared to pre-Covid than any other category, areas that are even more pronounced in Australia, where many directors have a sense that they need to catch up with global trends. Australian boards are also spending a notable amount of time on considerations related to energy transition, which, in the short term, is increasing costs for many. Consistent with our findings on who is influencing the board, attention to mainstream and activist shareholder concerns show the lowest increase, though among respondents in Australia CEO succession planning joins them at the bottom.

How are boards addressing the widening risk environment?

Most directors accept that the complexity, intensity, and accelerating rate of change in the boardroom requires a new approach to governance. Ironically, perhaps, in an environment where there is a call for leaders to have more expertise on every topic, what really helps them succeed are wisdom, business judgment, and learning. These capabilities have never been more important. Governing in this environment requires new and practical approaches to ensuring expertise and managing risk.

To better understand how boards are adjusting to this new reality, we asked what steps they have taken since Covid began to better manage uncertainty and risk. Respondents globally and in Australia remain anchored primarily in risk management practices that are “internal” in nature; that is, derived from interactions among the board itself and between the board and management. However, we also see a growing willingness to draw in the contributions of “external” experts.

Are boards more operationally involved?

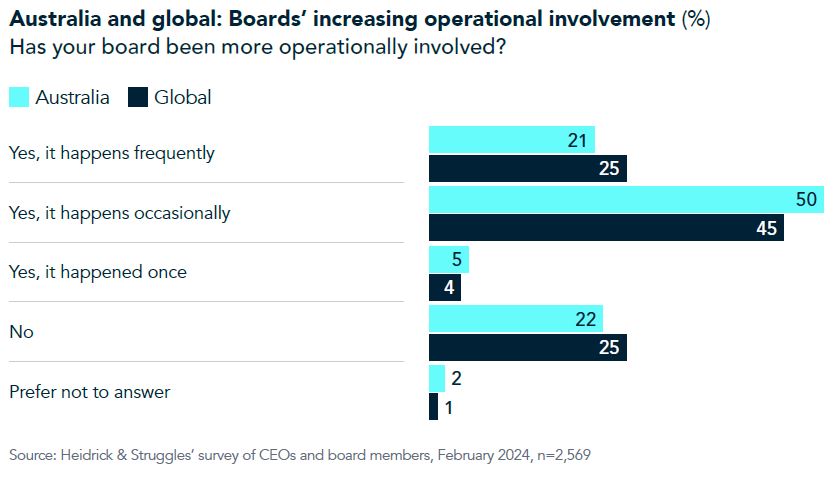

Globally, a majority of respondents report that board members are more operationally involved: 25% say it happens frequently; 45% occasionally; and 4% that it has happened once. Only a quarter report that they have not crossed that line. Notably, CEOs more often than directors report operational involvement from the board. The figures in Australia are similar.

How are boards engaging with the workforce?

Workers are increasingly influencing the board agenda globally. A number of trends are driving this, including demographic changes, income inequality concerns, talent shortages, inflation, the resurgence of labor unions in the United States, and the proliferation of social media organizing platforms. As we entered 2024, other recent research found, workforce attraction and retention was the third-highest concern of directors, behind geopolitical risk and economic uncertainty—but it ranked in the bottom half of issues the board feels the company is equipped to address.

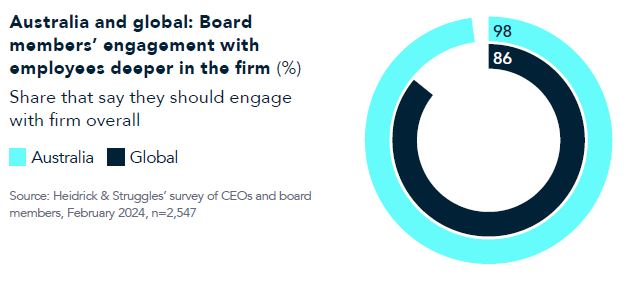

To better understand the impact of this on how the board does its work, we asked respondents how they think they should engage with employees other than the most senior executives. A significant majority (86%) believe directors should engage with employees deeper in the company; only 13% believe they should not (the rest said they didn’t know). In Australia the share seeking greater engagement was an even higher 98%.

How are boards thinking about diversity today?

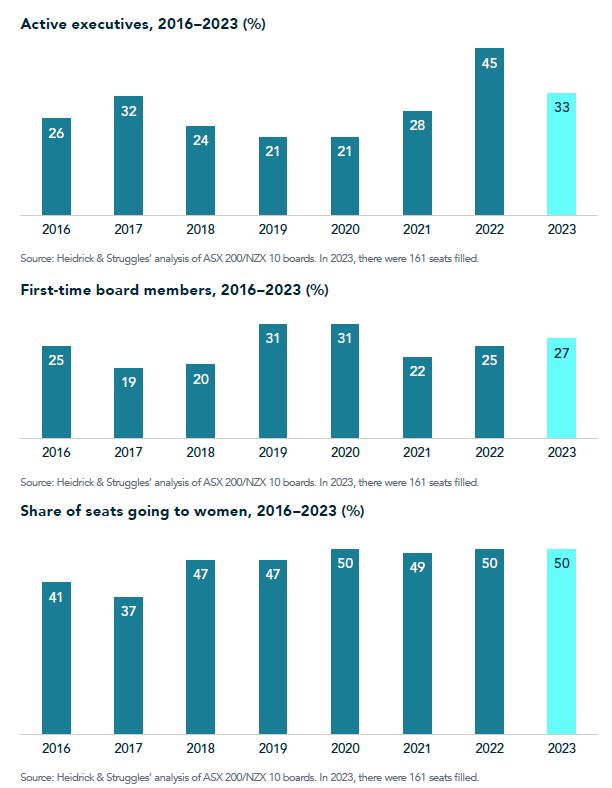

Each year, we analyze the new appointments to ASX 200 and NZX 10 boards, including overall turnover, new directors’ former and current executive roles, and age, among other aspects of their backgrounds. One way boards have focused on diversity is in adding Indigenous Australians and ensuring the voices of indigenous customers and communities are heard in the boardroom.

Summary

Change is a constant, and this has been particularly pointed for directors in recent years as society looks to business for more than it ever has. But the fog is clearing for boards that are learning to adapt. Many are finding that societal impact and shareholder value can go hand in hand, and, if managed well, the director role can be less overwhelming and more rewarding.

For more, download the full report.

Acknowledgments

Heidrick & Struggles wishes to thank the following executives for sharing their insights: Patricia McKenzie, Chair, AGL Energy, NSW Ports, and the Sydney Desalination Plant; and Peter Warne, Chair, IPH Limited, Non-executive director, Argo Investments Limited, UniSuper, and Virgin Australia. Their views are personal and do not necessarily represent those of the companies they are affiliated with.

Heidrick & Struggles also wishes to thank the following colleagues for their contributions to this article: Guy Farrow, Fergus Kiel, Graham Kittle, and Gaby Riddington.