Boards & Governance

Board Monitor Brazil 2024

Our analysis of the newest class of directors added to BOVESPA boards, and historical trends in the backgrounds of people being added to those boards, is available here.

For many years, Heidrick & Struggles has been tracking the trends that have shaped the global governance arena including important long-term changes in board independence, diversity, financial oversight, risk management, and in the shareholder base the directors serve.

More recently, we have been helping our clients understand the expanding environment in which they are operating. How is the role of business in society changing? What are the implications for directors? What does the future hold?

New approaches are emerging for boards and individual directors who see promise in this shifting landscape. In what follows, we draw on the results of two recent surveys of CEOs and directors around the world, and our experience, to describe how directors and CEOs are answering six questions that are reshaping the boardroom.

Six questions reshaping the boardroom

- Who is influencing the board agenda today—and are board members happy with that?

- Where does the board spend its time—and are those the right places?

- How are boards addressing the widening risk environment?

- Are boards more operationally involved?

- How should boards engage with the workforce?

- How are boards thinking about diversity today?

Who is influencing the board agenda—and are board members happy with that?

To better understand the relative influence of stakeholders today, we asked directors and CEOs to stipulate which stakeholders have accelerated their influence most in the post-Covid environment. Respondents across Latin America—in Brazil, Colombia, and Mexico—more often reported increased influence from almost every stakeholder group.

Given the direct fiduciary responsibility the board has to the company’s owners, and despite increased shareholder scrutiny and shareholder democratization policies in the asset management arena, it is notable that only 22% of global respondents reported the increased influence of mainstream shareholders and 13% for that of activist shareholders. The comparable figures in Latin America are 36% and 20%. Our survey data does not suggest that shareholders do not have influence in the boardroom, or that it isn’t growing; rather, that influence is not growing at the same rate as that of some other stakeholders. So, though a lot of attention is paid to the role of investors, changes in the ways boards approach their work may come first from the operational, commercial, and regulatory contributors to the business.

Where does the board spend its time—and are those the right places?

There is broad agreement globally, among both CEOs and directors, that the board meeting agenda remains primarily focused on “traditional board oversight responsibilities” (financial performance and risk, stockholder concerns, and strategy reviews, for example) and “traditional board leadership responsibilities” (CEO succession planning and leadership performance and compensation, for example). Together, these categories take up nearly 60% of boards’ time. External global risks, the opportunities and risks associated with technology (AI and cyber) and other stakeholder issues capture about 10% each in the balance of the meeting schedule. Crisis management and other topics round out the balance.

Globally, more respondents report spending more time on emerging technologies/AI and cybersecurity compared to pre-Covid than any other category. Consistent with our findings on who is influencing the board, attention to mainstream and activist shareholder concerns shows the lowest increase.

The Latin American survey data also highlights AI but shows some other notable differences in areas of increased focus, including stakeholder and mainstream shareholder concerns, organizational culture, and diversity.

How are boards addressing the widening risk environment?

Most directors accept that the complexity, intensity, and accelerating rate of change in the boardroom requires a new approach to governance. Ironically, perhaps, in an environment where there is a call for leaders to have more expertise on every topic, what really helps them succeed are wisdom, business judgment, and learning. These capabilities have never been more important. Governing in this environment requires new and practical approaches to ensuring expertise and managing risk.

To better understand how boards are adjusting to this new reality, we asked what steps they have taken since Covid began to better manage uncertainty and risk. Respondents remain anchored primarily in risk management practices that are “internal” in nature; that is, derived from interactions among the board itself and between the board and management. However, we also see a growing willingness to draw in the contributions of “external” experts. Respondents in Latin America are somewhat less focused on talking more with management and somewhat more focused on advisory boards.

Are boards more operationally involved?

Few dispute that more is at stake, and more is expected of directors now.1 As the role of business in society expands, directors have been grappling with the boundaries of their respective roles. This has accelerated since Covid and is testing the sacrosanct “nose in, fingers out” standard that marks an important boundary between the board and management in ways we have not seen until recently.

To better understand this complicated issue, we asked directors and CEOs the following question: “There is an impression that many board members are more operationally involved than ever before, some crossing the traditional line between oversight and management. Have you seen this on your board?”

Globally, a majority of respondents report that board members are more operationally involved: 25% say it happens frequently; 45% occasionally; and 4% that it has happened once. Notably, CEOs more often than directors report operational involvement from the board. Survey respondents in Latin America far more often than others say involvement is frequent.

How are boards engaging with the workforce?

Workers are increasingly influencing the board agenda globally. To better understand the impact of this on how the board does its work, we asked respondents how they think they should engage with employees other than the most senior executives. A significant majority (86%) believe directors should engage with employees deeper in the company. The figure for Latin American survey respondents is slightly higher, at 88%, with CEOs and directors tied.

On a global basis, respondents most often preferred to engage with the workforce through the use of surveys, town halls, and direct engagement with small groups of employees without management present. Latin American leaders were generally less interested in surveys as a way of understanding employee concerns than peers in other countries.

How are boards thinking about diversity today?

Traditionally, boards in emerging regions have favored conventional professional profiles, leading to a homogeneity in age, background, and expertise. A director in Brazil noted that “new board nominations are predominantly made through informal networks, where one individual calls another.” This practice underscores the fundamental challenge of achieving diversity within these boards.

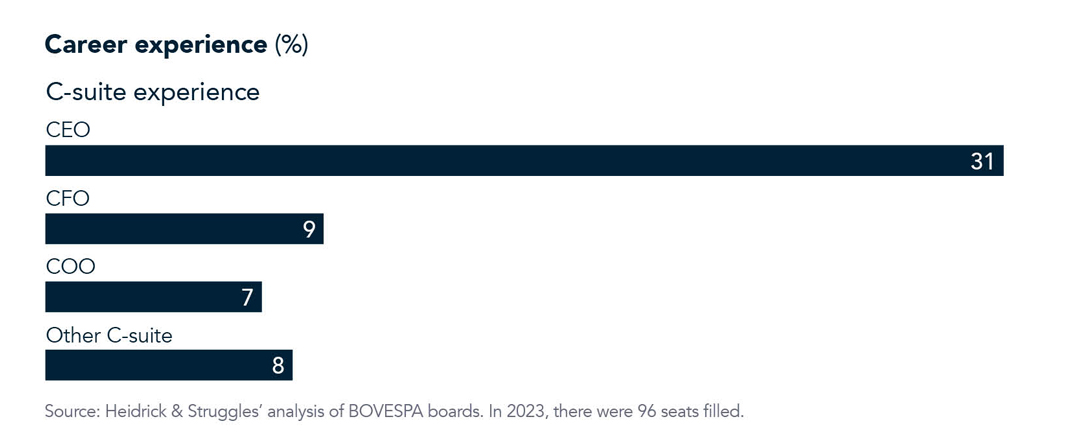

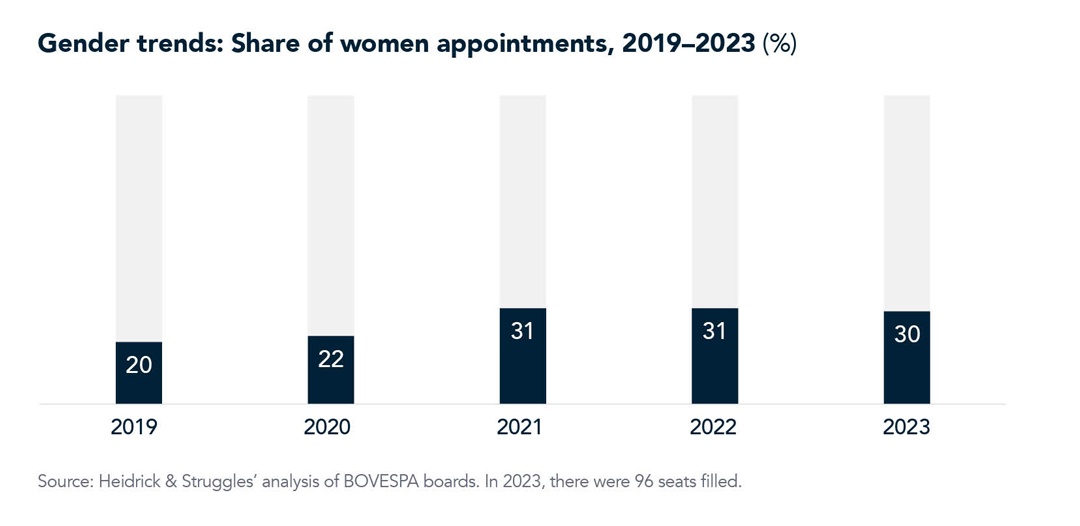

Nonetheless, diversity trends are slowly improving in Brazil. Women represented 30% of the BOVESPA board appointments in 2023, maintaining the rate among new appointments that we’ve seen since 2021.

Recommendations

Change is a constant, and this has been particularly pointed for directors in recent years as society looks to business for more than it ever has. But the fog is clearing for boards that are learning to adapt. Many are finding that societal impact and shareholder value can go hand in hand, and, if managed well, the director role can be less overwhelming and more rewarding. Following are a set of recommendations that reflect adjustments effective boards are making.

- Increase stakeholder engagement

- Cultivate a learning culture on the board

- Expand sources of expertise

- Increase investment in succession planning

- Govern across boundaries

- Leverage others

Acknowledgments

Heidrick & Struggles wishes to thank the following executives for sharing their insights: Clarissa Lins, founding partner at Catavento and non-executive board member in public companies in Brazil and abroad; João Teixeira, non-executive board member in public companies in Brazil and abroad; and Deborah Stern Vieitas, non-executive board member in public companies in Brazil. Their views are personal and do not necessarily represent those of the companies they are affiliated with.

Heidrick & Struggles also wishes to thank the following colleagues for their contributions to this article: Gustavo Alba, Ricardo Amatto, Paula Guerra, Marcos Macedo, and Isabella Camacho.

Reference

1 For more on these evolving expectations, see Jeremy Hanson and Tim Gallagher, “CEO and board succession in the age of impact: An evolving model: Trends and recommendations,” Heidrick & Struggles, heidrick.com; and The Future of the American Board, NACD, October 13, 2022, nacdonline.org, p. 11.