Boards & Governance

Board Monitor Colombia 2024

Our analysis of the newest class of directors added to COLCAP boards, and historical trends in the backgrounds of people being added to those boards, is available here.

For many years, Heidrick & Struggles has been tracking the trends that have shaped the global governance arena including important long-term changes in board independence, diversity, financial oversight, risk management, and in the shareholder base the directors serve.

More recently, we have been helping our clients understand the expanding environment in which they are operating. How is the role of business in society changing? What are the implications for directors? What does the future hold?

Clarity has been hard to find as directors struggle to draw reasonable boundaries and consider their responsibilities in the midst of a rolling global pandemic, geopolitical uncertainty and conflict, emerging technologies, cybersecurity concerns, and a long list of social and environmental concerns. While there are important industry and regional differences—indeed, differences from one company to another, most accept that the role of the board is expanding. More is at stake. More is uncertain. And more is expected now of directors.

While this expanding role creates added pressures, it is also creating opportunity. New approaches are emerging for boards and individual directors who see promise in this shifting landscape. In what follows, we draw on the results of two recent surveys of CEOs and directors around the world, and our experience, to describe how directors and CEOs are answering six questions that are reshaping the boardroom.

Six questions reshaping the boardroom

- Who is influencing the board agenda today—and are board members happy with that?

- Where does the board spend its time—and are those the right places?<.li>

- How are boards addressing the widening risk environment?

- Are boards more operationally involved?

- How should boards engage with the workforce?

- How are boards thinking about diversity today?

Who is influencing the board agenda—and are board members happy with that?

To better understand the relative influence of stakeholders today, we asked directors and CEOs to stipulate which stakeholders have accelerated their influence most in the post-Covid environment. Overall, they report that the CEO and leadership team, the broader workforce, regulators, and consumers and customers have increased their influence more than others. Respondents across Latin America—in Brazil, Colombia, and Mexico—more often reported increased influence from almost every stakeholder group.

We also asked respondents how satisfied they are with the current influence of stakeholders, generally and on a relative basis. A majority of respondents globally report a high level of satisfaction (76%). Latin American respondents were minimally less satisfied, at 73%.

Where does the board spend its time—and are those the right places?

More and more companies are learning to thrive in this environment, adjusting to consider and address an expanding number of issues. As new influences come to the fore, boards are also shifting how they spend their time. We asked directors and CEOs both how they split their time in meetings and which topics receive more of their attention in a post-Covid environment.

Globally, more respondents report spending more time on emerging technologies/AI and cybersecurity compared to pre-Covid than any other category. Consistent with our findings on who is influencing the board, attention to mainstream and activist shareholder concerns shows the lowest increase.

The Latin American survey data also highlights AI but shows some other notable differences in areas of increased focus, including stakeholder and mainstream shareholder concerns, and diversity.

How are boards addressing the widening risk environment?

Most directors accept that the complexity, intensity, and accelerating rate of change in the boardroom requires a new approach to governance. Ironically, perhaps, in an environment where there is a call for leaders to have more expertise on every topic, what really helps them succeed are wisdom, business judgment, and learning. These capabilities have never been more important. Governing in this environment requires new and practical approaches to ensuring expertise and managing risk.

To better understand how boards are adjusting to this new reality, we asked what steps they have taken since Covid began to better manage uncertainty and risk. Respondents remain anchored primarily in risk management practices that are “internal” in nature; that is, derived from interactions among the board itself and between the board and management. However, we also see a growing willingness to draw in the contributions of “external” experts.

Respondents in Latin America are somewhat less focused on talking more with management and somewhat more focused on advisory boards.

Are boards more operationally involved?

As the role of business in society expands, directors have been grappling with the boundaries of their respective roles. This has accelerated since Covid and is testing the sacrosanct “nose in, fingers out” standard that marks an important boundary between the board and management in ways we have not seen until recently.

To better understand this complicated issue, we asked directors and CEOs the following question: “There is an impression that many board members are more operationally involved than ever before, some crossing the traditional line between oversight and management. Have you seen this on your board?”

Globally, a majority of respondents report that board members are more operationally involved: 25% say it happens frequently; 45% occasionally; and 4% that it has happened once. Only a quarter report that they have not crossed that line. Notably, CEOs more often than directors report operational involvement from the board. Survey respondents in Latin America far more often than others say involvement is frequent.

How are boards engaging with the workforce?

Workers are increasingly influencing the board agenda globally. A number of trends are driving this, including demographic changes, income inequality concerns, talent shortages, inflation, the resurgence of labor unions in the United States, and the proliferation of social media organizing platforms.

To better understand the impact of this on how the board does its work, we asked respondents how they think they should engage with employees other than the most senior executives. A significant majority (86%) believe directors should engage with employees deeper in the company; only 13% believe they should not (the rest said they didn’t know). But there is a notable difference between CEOs and directors: 93% of directors believe they should engage; 82% of CEOs say the same. The figure for Latin American survey respondents is slightly higher, at 88%, with CEOs and directors tied.

On a global basis, respondents most often preferred to engage with the workforce through the use of surveys, town halls, and direct engagement with small groups of employees without management present. Latin American leaders were generally less interested in surveys as a way of understanding employee concerns than peers in other countries.

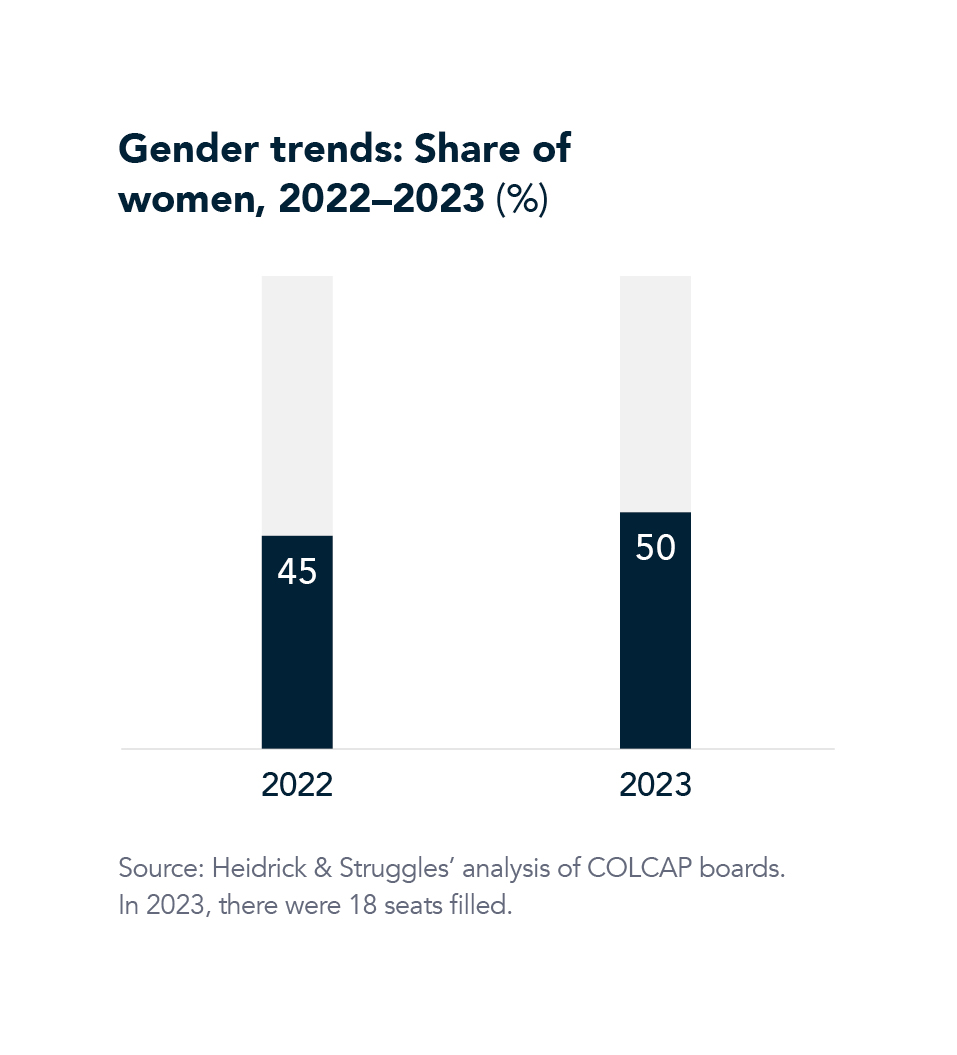

How are boards thinking about diversity today?

The business world, for all its faults, has proven its ability to respect our differences, using them as a source of valuable debate, and to work above and around our divisions to solve complex problems, drive innovation, and create value. Governing and leading across abiding cultural divisions may be the most important thing business has to offer society.

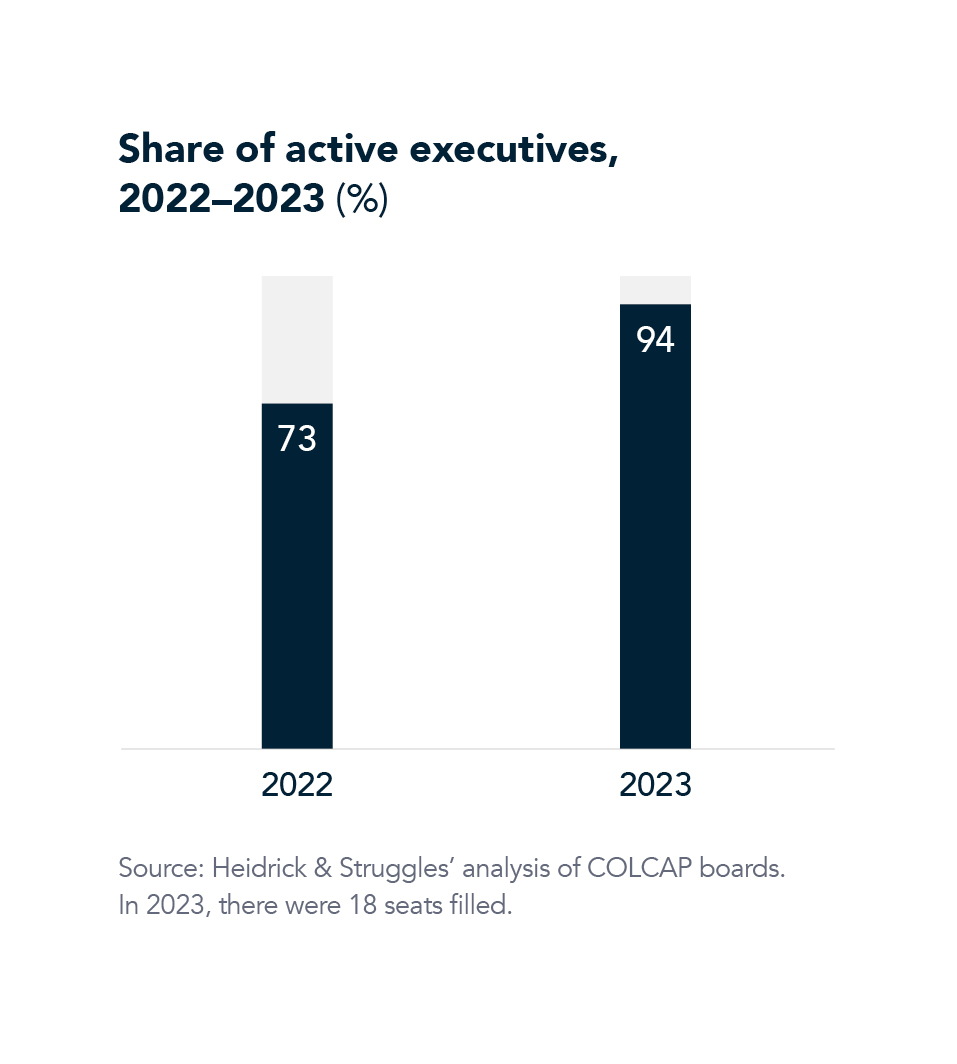

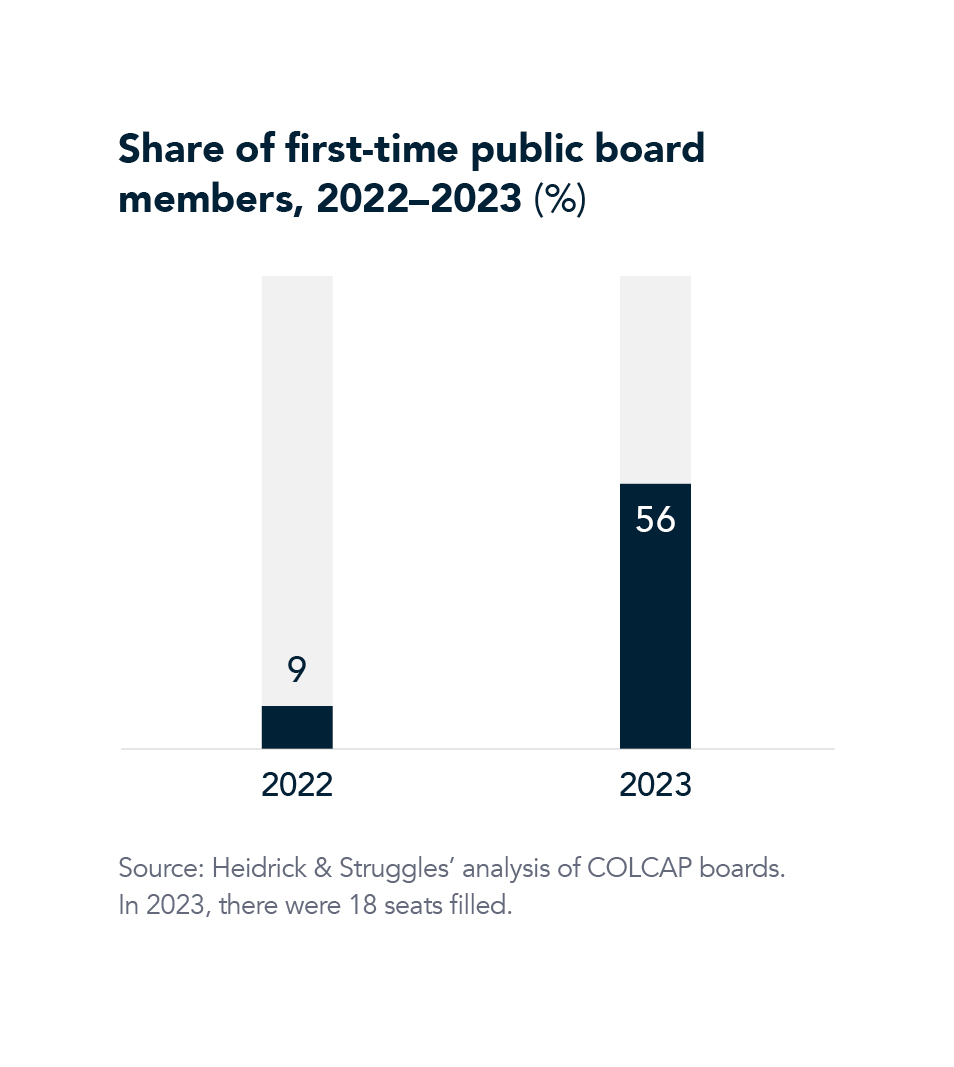

Diversity among the newest directors

Recommendations

- Increase stakeholder engagement

- Cultivate a learning culture on the board

- Expand sources of expertise

- Increase investment in succession planning

- Govern across boundaries

- Leverage others

Acknowledgments

Heidrick & Struggles wishes to thank the following executives for sharing their insights: Camilo Bueno, Vice president, Growth & Strategy, and lead partner, Board Leadership Center, KPMG; Mónica Contreras, former CEO, PepsiCo Andean & TGI; Camila Escobar, CEO, Juan Valdez Café; Esteban Iriarte, board member, Sura Asset Management & US Cellular; and Ana Fernanda Maiguashca, president, Private Competitiveness Council. Their views are personal and do not necessarily represent those of the companies they are affiliated with.

Heidrick & Struggles also wishes to thank the following colleagues for their contributions to this article: Roberto Hall and Sonia Perdomo.