Boards & Governance

Board Monitor UAE 2024

For many years, Heidrick & Struggles has been tracking the trends that have shaped the global governance arena including important long-term changes in board independence, diversity, financial oversight, risk management, and in the shareholder base the directors serve.

More recently, we have been helping our clients understand the expanding environment in which they are operating. How is the role of business in society changing? What are the implications for directors? What does the future hold?

Clarity has been hard to find as directors struggle to draw reasonable boundaries and consider their responsibilities in the midst of a rolling global pandemic, geopolitical uncertainty and conflict, emerging technologies, cybersecurity concerns, and a long list of social and environmental concerns. While there are important industry and regional differences—indeed, differences from one company to another, most accept that the role of the board is expanding. More is at stake. More is uncertain. And more is expected now of directors.

New approaches are emerging for boards and individual directors who see promise in this shifting landscape. In what follows, we draw on the results of two recent surveys of CEOs and directors around the world, and our experience, to describe how directors and CEOs are answering six questions that are reshaping the boardroom.

Six questions reshaping the boardroom

- Who is influencing the board agenda today—and are board members happy with that?

- Where does the board spend its time—and are those the right places?

- How are boards addressing the widening risk environment?

- Are boards more operationally involved?

- How should boards engage with the workforce?

- How are boards thinking about diversity today?

Who is influencing the board agenda today—and are board members happy with that?

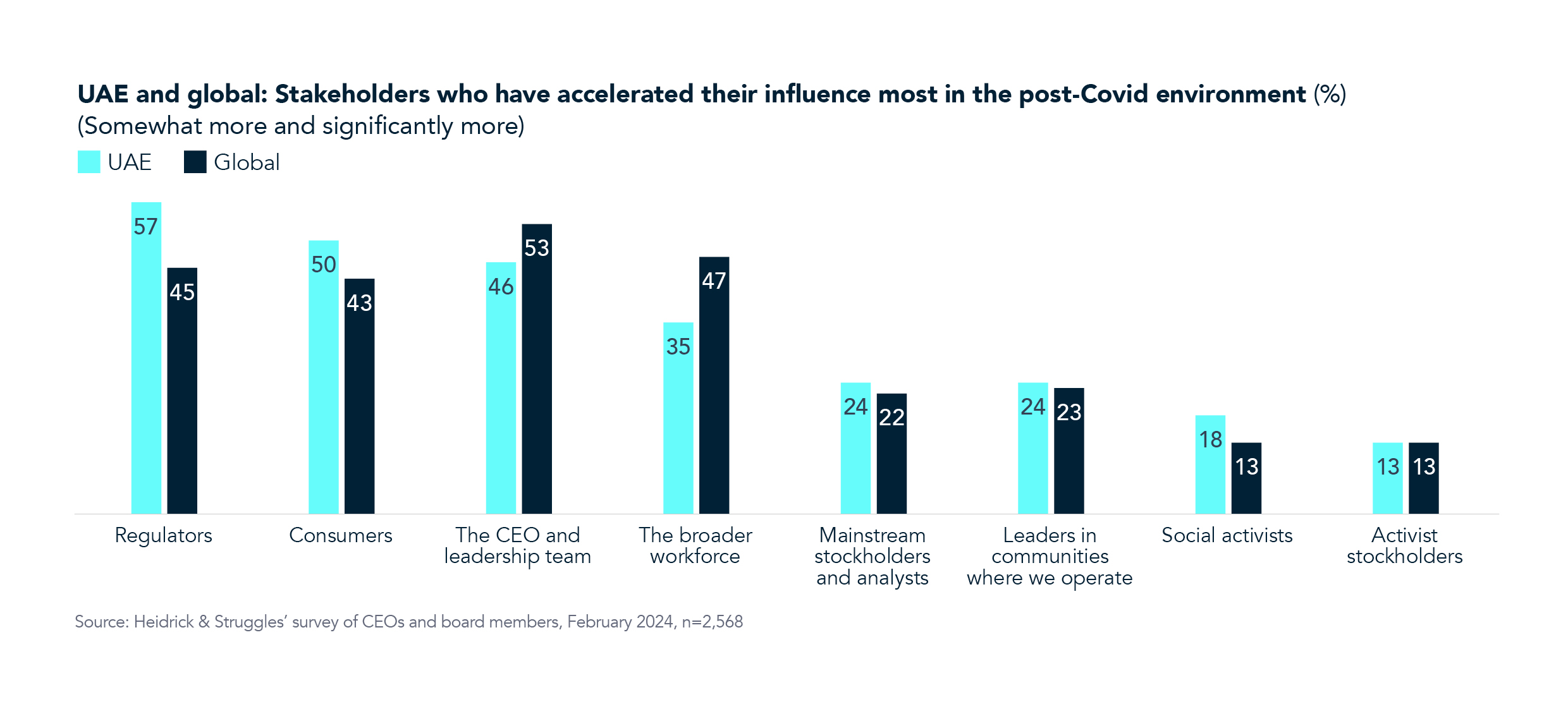

To better understand the relative influence of stakeholders today, we asked directors and CEOs to stipulate which stakeholders have accelerated their influence most in the post-Covid environment. For the UAE, specifically, we can see that regulators have certainly accelerated their influence on the board’s agenda and decision-making, with 57% of respondents highlighting this versus only 45% of the respondents globally. Consumers are identified as the second stakeholder group that has more influence on boards in the UAE today, with 50% of respondents selecting this versus only 43% globally. Globally, the CEO and leadership team and the broader workforce have also become more influential in driving board agenda and decision making.

The increasing influence of regulators in the UAE and in the GCC region more broadly is a continuing trend, driven in part by the changing regulatory landscape and the demand on boards to constantly stay abreast of and respond to regulatory changes with focus on improving board governance. Increasing influence from consumers is a new emerging trend and seen more prominently in the UAE, as compared to global average. Growing consumer influence requires boards to develop a deeper understanding of their consumers’ needs and preferences, requiring more diverse voices on the board that reflect those of the consumers.

We can expect more access to, and influence on, boards from a range of stakeholders as a growing trend over the next few years. Boards in the UAE and around the world need to prepare to engage with this broader stakeholder group while also balancing competing demands and effectively managing their time spent on stakeholder engagement. The focus should also be on adding more diverse voices on the board to better reflect and respond to a diverse stakeholder group.

Where does the board spend its time—and are those the right places?

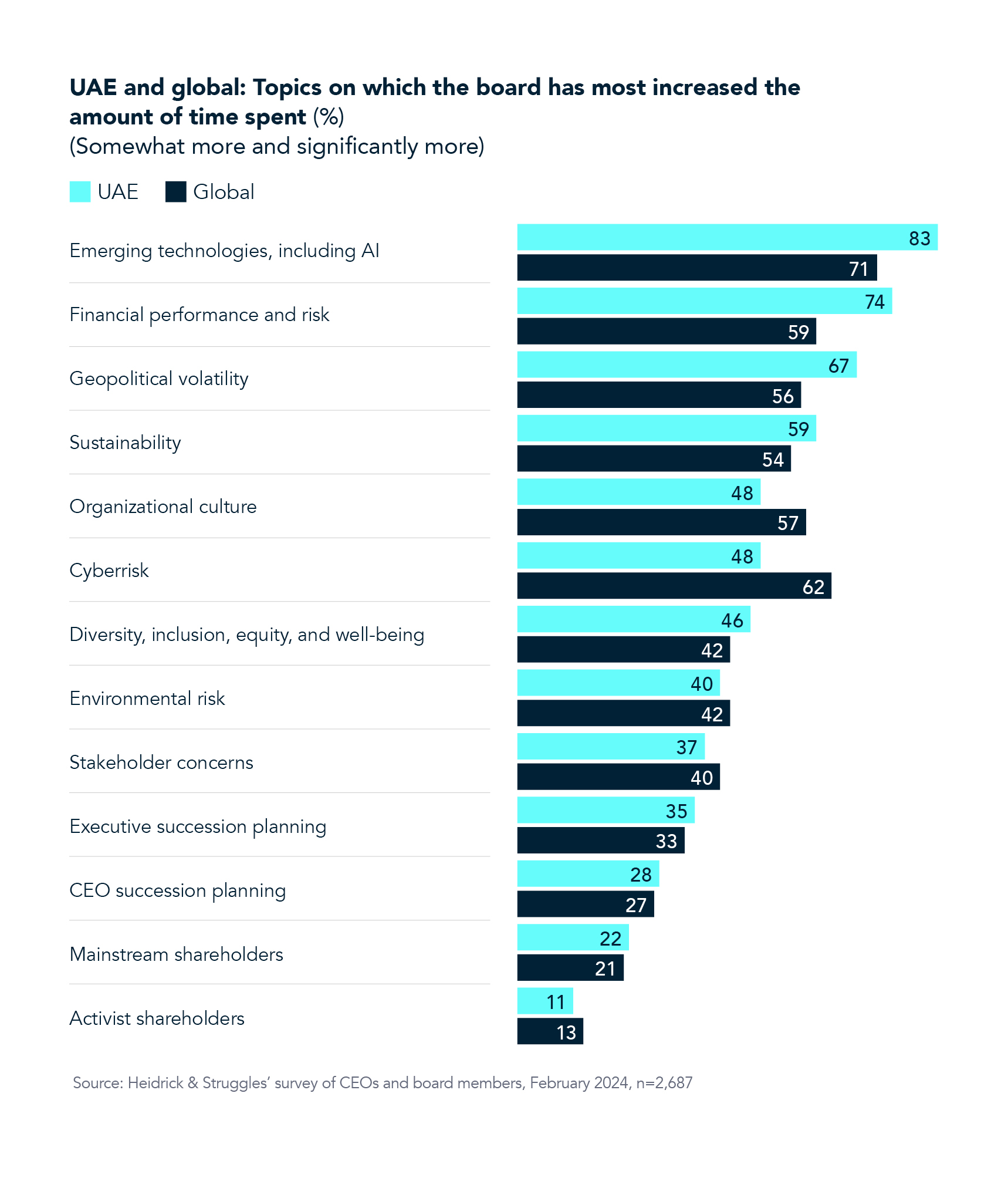

Globally, more respondents report spending more time on emerging technologies/AI and cybersecurity compared to pre-Covid than any other category. This is even more pronounced in the UAE, with 83% of respondents saying that they are spending more time on emerging technologies, compared to 71% globally. This finding reflects the overall focus and investment in the space of advanced technologies and AI in the UAE, with several government and private sector investments to drive growth in this space. We also see that significantly more respondents in the UAE report spending time on financial performance and risk, geopolitical stability, and sustainability compared to global peers.

Boards in the UAE and globally can expect to continue to operate in an environment where more is at stake (with geopolitical uncertainty and climate change) and more is uncertain (with constant technological advancements). Boards need to be ready on an ongoing basis for change and build the ability to pivot to relevant focus areas with an emphasis on building the right capabilities withing the board and organizational leadership.

How are boards addressing the widening risk environment?

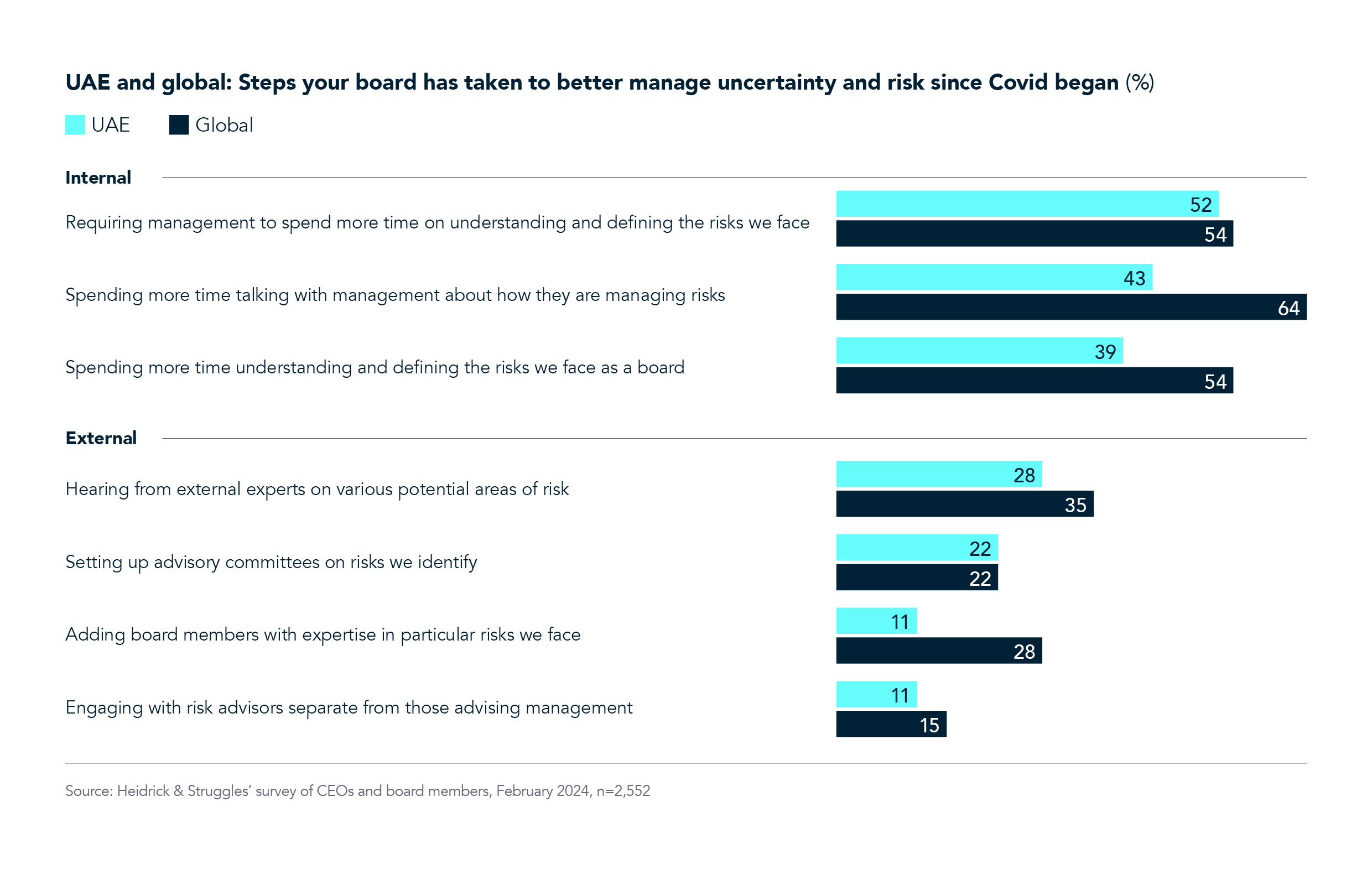

Respondents in the UAE, similar to the global view, are requiring management to spend more time on understanding and defining risks. However, we see less emphasis on boards spending more time talking with management about risks and understanding and defining the risks for the board. Boards in the UAE are fully aligned with the global view when it comes to a focus on setting up advisory committees on identified risks. The increased focus on advisory committees globally may reflect a trend toward evolving board governance mechanisms, with focus on problem solving through relevant expertise going hand in hand with board decision making.

Post-Covid, the risk landscape has widened for businesses. While companies remain anchored in financial and operational risk management practices, the spectrum is growing and now includes significant emerging cybersecurity, AI, and geopolitical risks on top of growing environmental and social concerns and regulations. According to the BDI Board Effectiveness Review 2023, boards in the UAE and GCC more broadly now expect to incorporate a broader set of risks into scenario planning. Further, boards also need to maintain a more flexible approach to agenda setting to adequately address new risks as they arise.1

Are boards more operationally involved?

To better understand this complicated issue, we asked directors and CEOs the following question: “There is an impression that many board members are more operationally involved than ever before, some crossing the traditional line between oversight and management. Have you seen this on your board?”

Globally, a majority of respondents report that they are more operationally involved; 25% say it happens frequently; 45% occasionally; 4% that it has happened once. Only a quarter report that they have not crossed that line. Notably, CEOs more often than directors report operational involvement from the board.

When we look at a country-level view, we see that 52% of the respondents in the UAE say that this happens frequently—the highest figure across all countries. Board involvement in day-to-day management has long been more common in the UAE and the GCC region more broadly, than in other regions, and continues to be so.

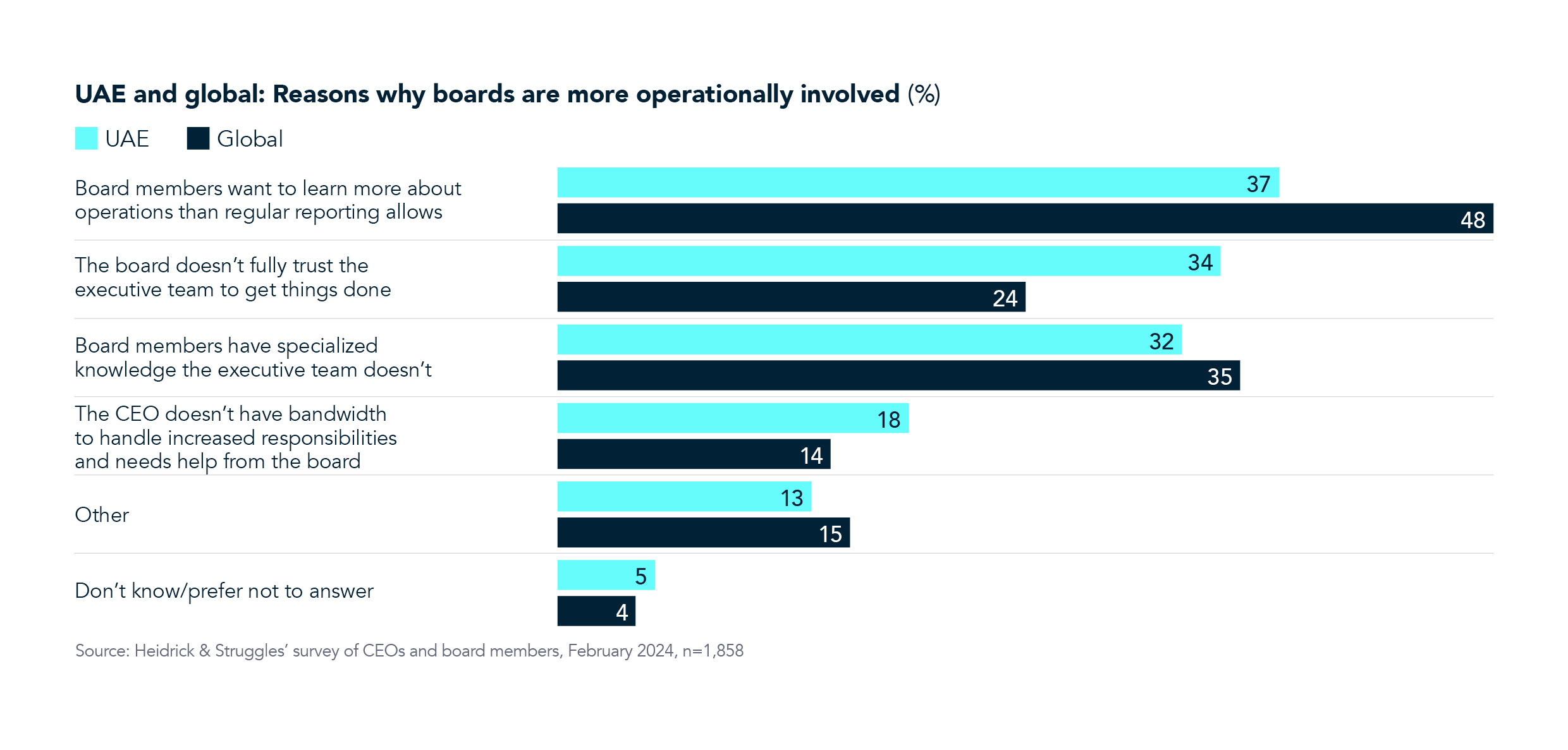

In the UAE, the top two reasons cited for more operational involvement from the board include board members wanting to learn more about operations than regular reporting allows (similar to the global view), and the board not fully trusting the executive team to get things done (higher than the global share.)

How are boards engaging with the workforce?

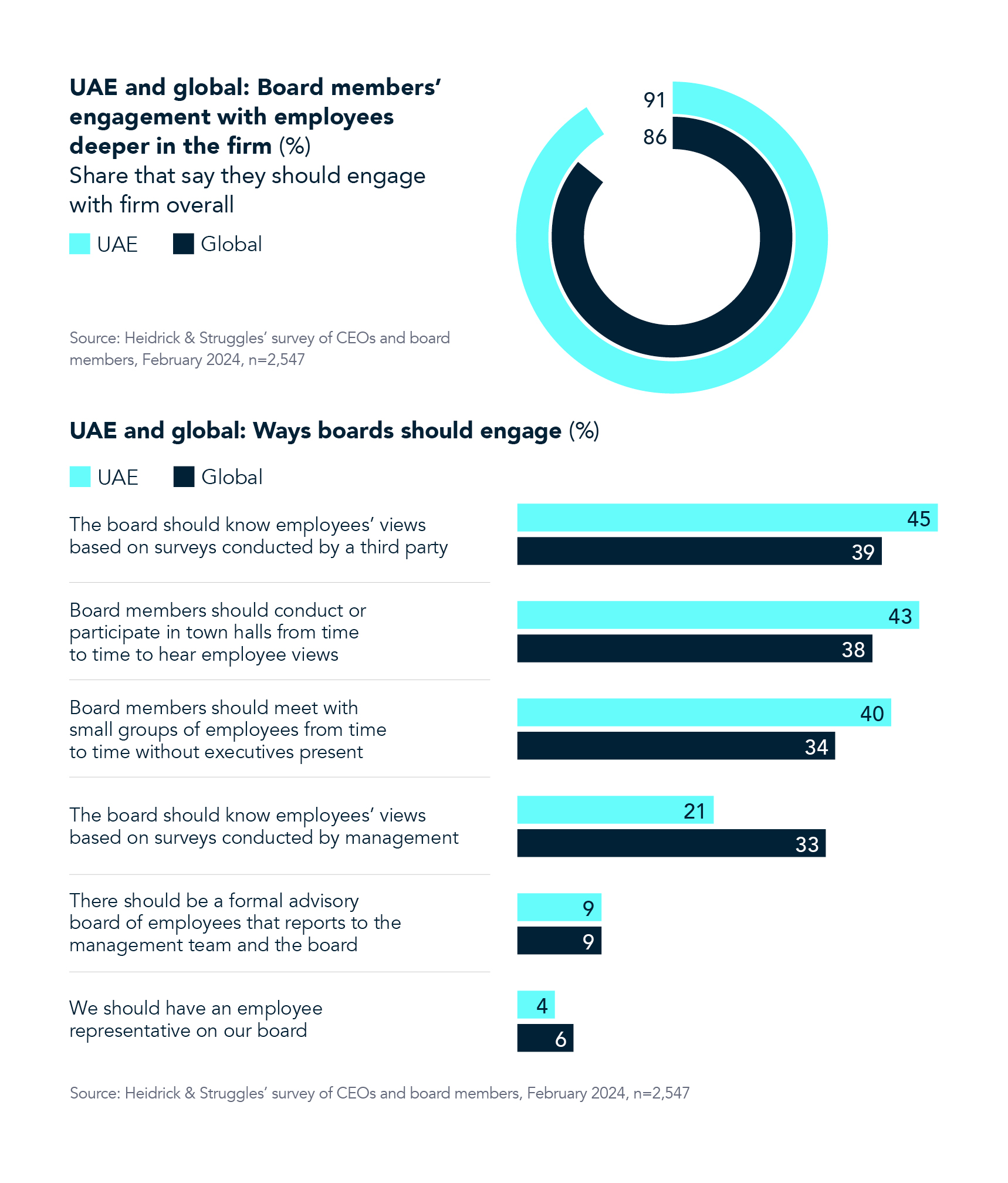

Perhaps not surprisingly, given their deeper operational engagement than directors in many other regions, leaders in the UAE are even more keen on direct engagement with the workforce in a number of ways, with 91% of respondents in the UAE saying that they should engage more with the firm overall.

How are boards thinking about diversity today?

In light of some of the themes shaping global and UAE boards today—including more being at stake and uncertain, increasing involvement from diverse set of stakeholders, and growing expectations for the board—ensuring board diversity with the right balance of expertise, demographics, and widening of perspectives is even more important today than it has been in the past.

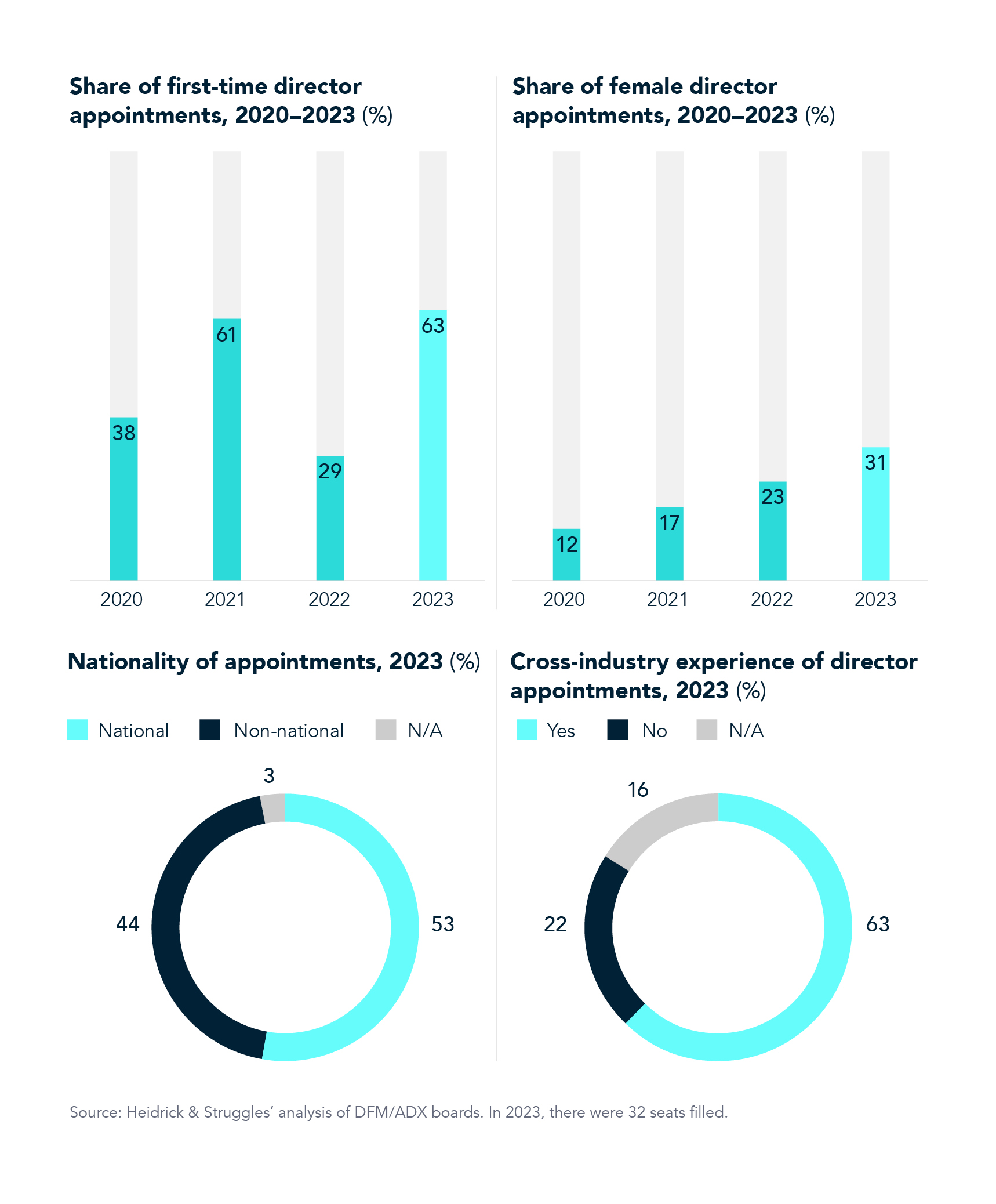

When looking at 2023 board appointments in the UAE, we see positive trends, including an increased share of first-time board members, a growing share of women on boards, a balance of nationals and non-nationals on boards, and cross-industry experience on boards.

We see a continuous focus on improving board diversity within boards in the UAE, with positive trends this year on increasing the share of first-time board members, adding women on boards, a good balance of nationals versus expats, and nearly two-thirds having cross-industry experience. Regulation, such as the requirement to have at least one woman director on boards of publicly listed companies in the UAE, and the very recently passed regulation of having at least one women director on boards of private joint-stock firms (to come into effect January 2025), has also supported the trend toward increasing board diversity. We are also seeing an emerging trend of more young leaders being included on boards or given relevant training to take on future board positions. Boards in the UAE should maintain this momentum and continue to strengthen board composition through demographic diversity as well as diversity of experience.

Recommendations

Boards globally and also within the UAE are looking at a range of options and actions to improve board diversity, as well as governance.

Following are a set of recommendations that reflect adjustments effective boards are making:

- Expand sources of expertise

- Avoid over-boarding

- Increase your investment in board succession

- Invest in bringing younger talent onto the board

- Cultivate a learning culture on the board

- Take peer and self-evaluation, and board refreshment, seriously

- Leverage others

Acknowledgments

Heidrick & Struggles wishes to thank the following executive for sharing their insights: Mohammed Al-Shroogi, chairman, GCC Board Directors Institute; H.E. Eng. Abdullatif A. Al-Othman, governor, GCC Board Directors Institute; and Marwa Al Mansoori, board member, Abu Dhabi Chamber of Commerce and Industry. Their views are personal and do not necessarily represent those of the companies they are affiliated with.

Heidrick & Struggles also wishes to thank the following colleagues for their contributions to this article: Richard Guest, Maliha Jilani, and Shaloo Kulkarni.

Reference

1 Board Effectiveness Review 2023: Determining board effectiveness across the GCC, GCC Board Directors Institute and Heidrick & Struggles, 2023.