CEO & Board of Directors

Board Monitor UK 2024 | Navigating shifting sands: Six ways boards are reshaping their processes to thrive now

As the role of the board is expanding, with more being expected of directors in the context of increasingly uncertain times, we are exploring the implications in the way boards operate and evolve. How is the role of business in society changing? What are the implications for directors? What does the future hold?

Around the globe, boards are tackling geopolitical uncertainty and conflict, emerging technologies, cybersecurity concerns, and a long list of social and environmental concerns. In the United Kingdom, directors also face an ever-increasing regulatory burden and a weakened position in global equity markets in the context of a polarized political climate that is creating an acute sense of pressure for many board members.

But this expanded role is also creating opportunity. New approaches are emerging for boards and individual directors who see promise in this shifting landscape. In what follows, we draw on the results of two recent surveys of CEOs and directors around the world, as well as our experience, to describe how directors and CEOs are answering six questions that are reshaping the boardroom.

Six questions reshaping the boardroom

- Who is influencing the board agenda today—and are board members happy with that?

- Where does the board spend its time—and are those the right places?

- How are boards addressing the widening risk environment?

- Are boards more operationally involved?

- How should boards engage with the workforce?

- How are boards thinking about diversity today?

Who is influencing the board agenda today—and are board members happy with that?

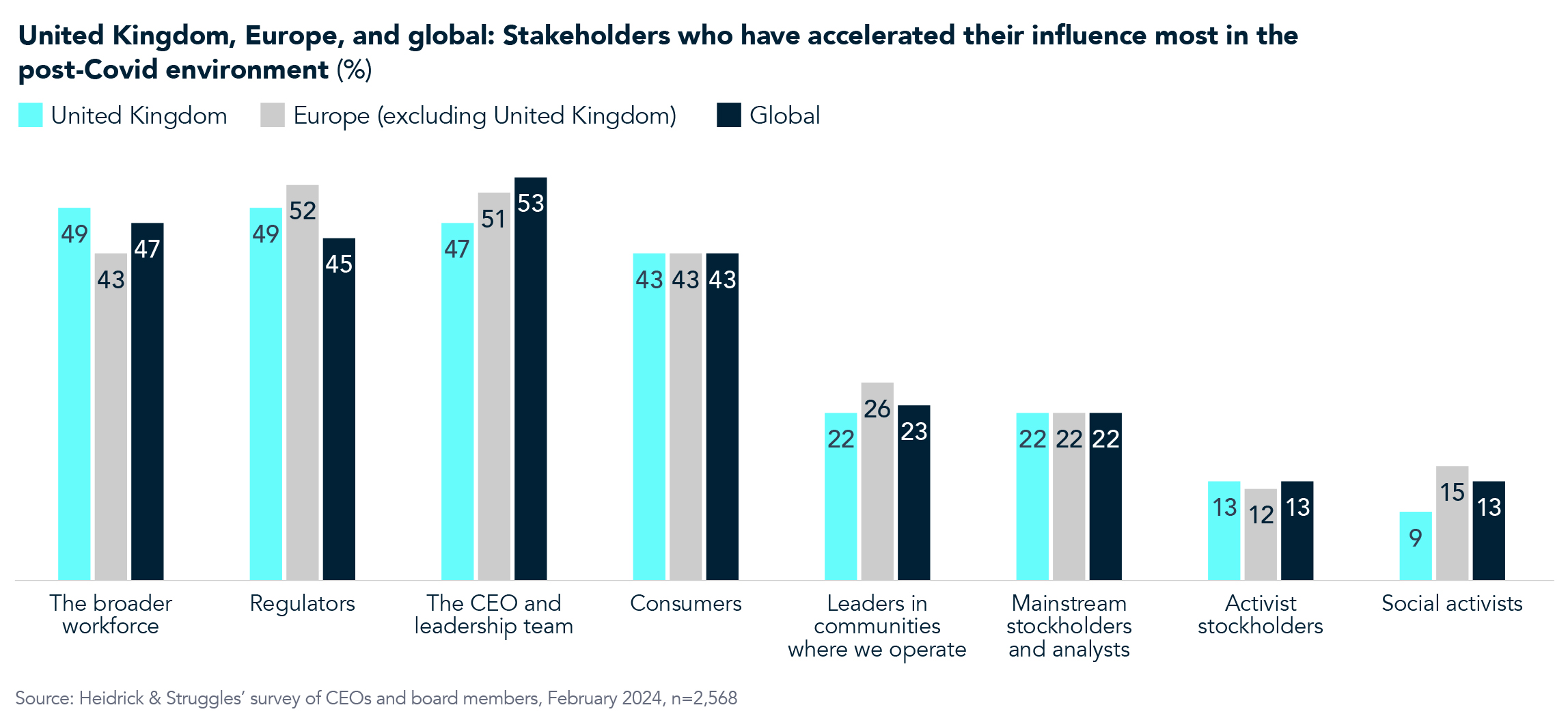

To better understand the relative influence of stakeholders today, we asked directors and CEOs to stipulate which stakeholders have accelerated their influence most in the post-Covid environment. Overall, they report that the CEO and leadership team, the broader workforce, regulators, and consumers and customers have increased their influence more than others.

Interestingly, given the direct fiduciary responsibility the board has to the company’s owners, and despite increased shareholder scrutiny and shareholder democratization policies in the asset management arena, a relatively low number of UK respondents report increased influence from mainstream investors (22%) or from activist investors (13%), consistent with the global average. So, though attention is paid to the role of activists, and there have been a number of high-profile takeover approaches in recent months, changes in the ways boards approach their work may not come first, now, from the shareholders they serve, but rather from the operational, commercial, and regulatory contributors to the business. In the United Kingdom (and Europe), regulators top the list of those having more influence.

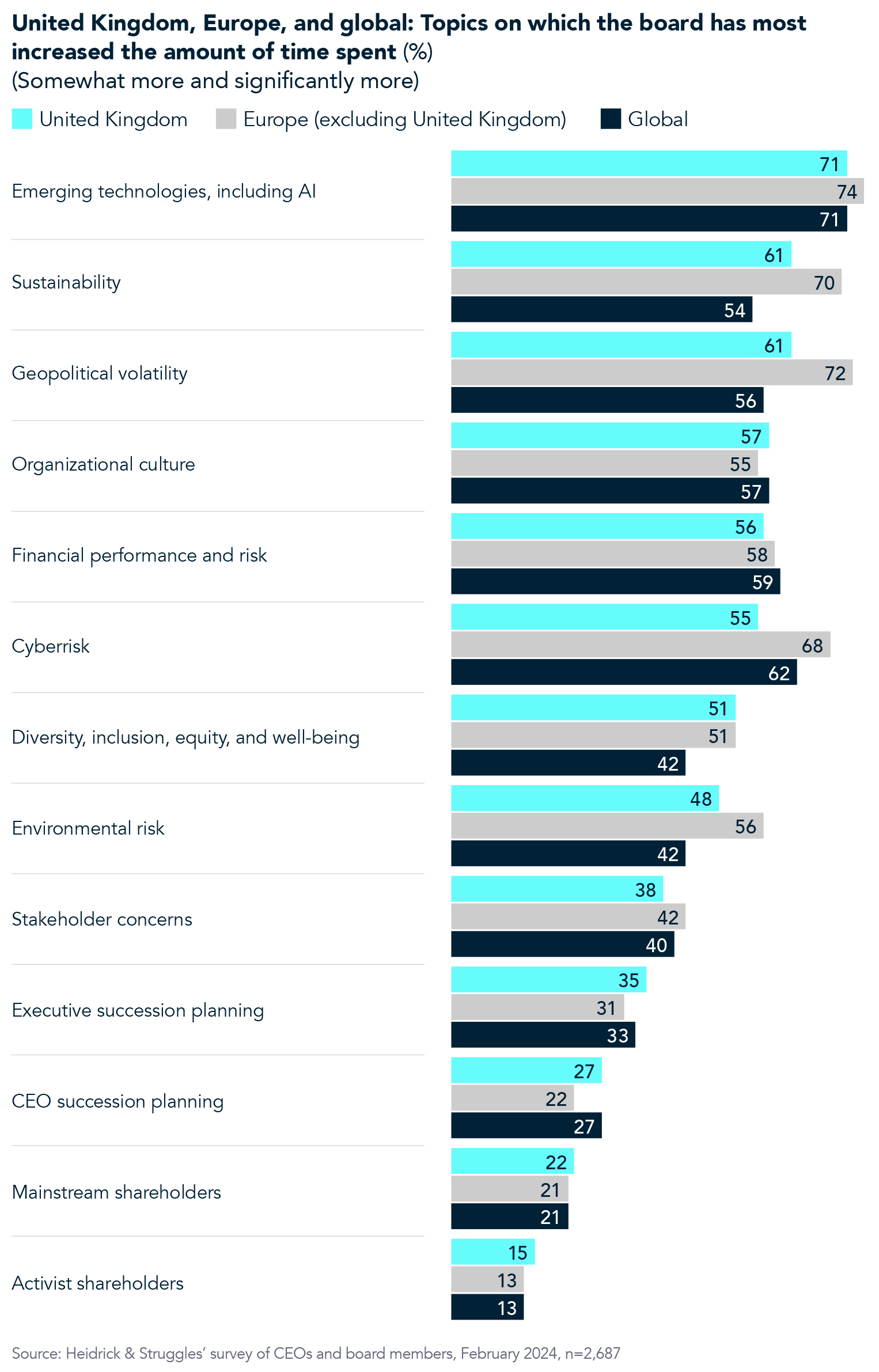

Where does the board spend its time—and are those the right places?

A higher share of respondents in the United Kingdom report an increase in time spent on emerging technology and AI concerns than any other area, consistent with the average global response. Sustainability is another very high priority for time spent in UK boardrooms, notably higher than the average global response.

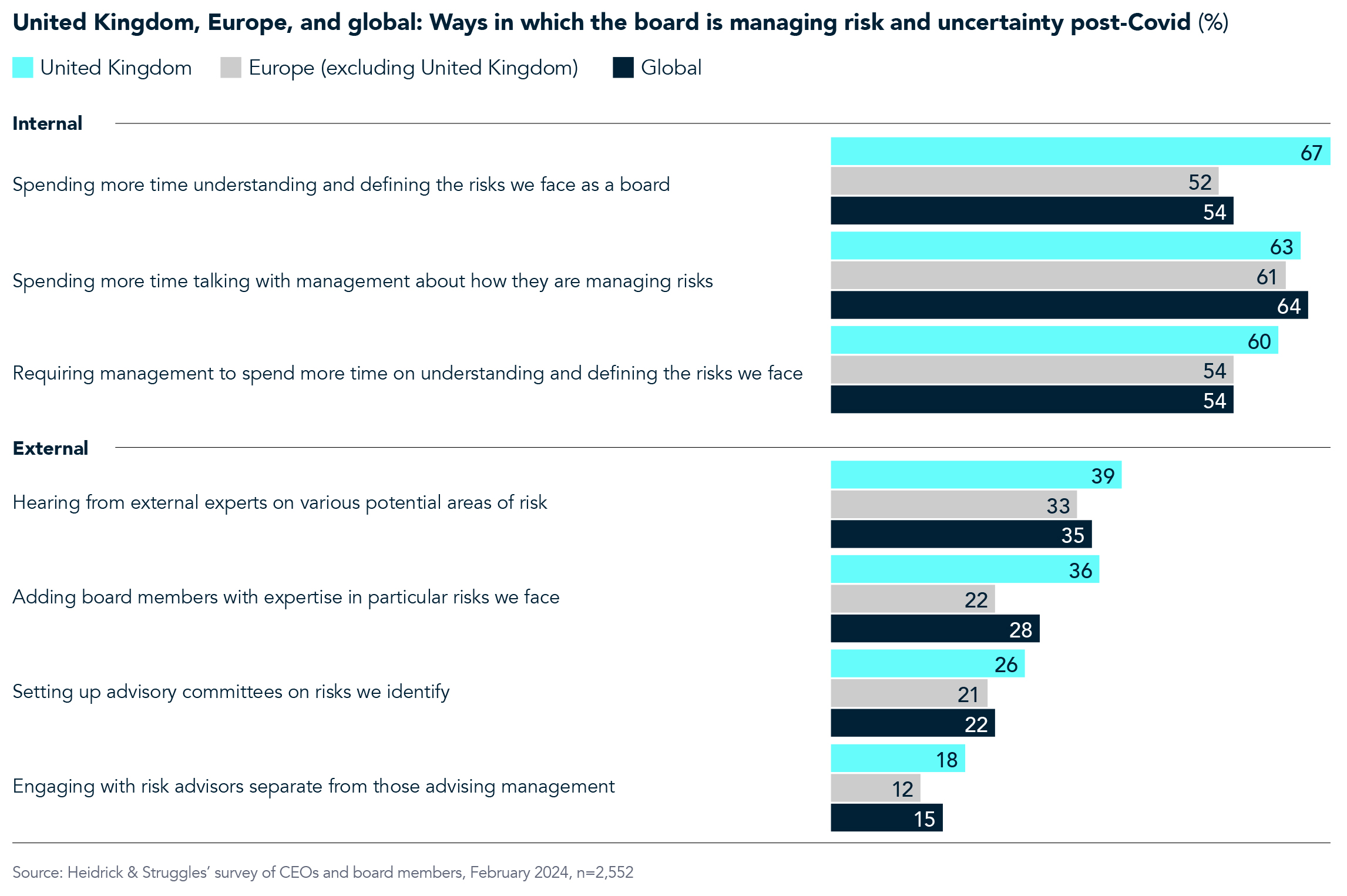

How are boards addressing the widening risk environment?

When we asked what steps they have taken since Covid began to better manage uncertainty and risk, we found that respondents remain anchored primarily in risk management practices that are internal in nature; that is, derived from interactions among the board itself and between the board and management. However, we also see a growing willingness to draw in the contributions of “external” experts.

UK board members indicate they are doing more and doing these things more often to address risk than directors in almost any other region—and are the highest globally in spending more time understanding and defining risks. All these efforts add to the overall burden on board members that so many in the United Kingdom are feeling acutely.

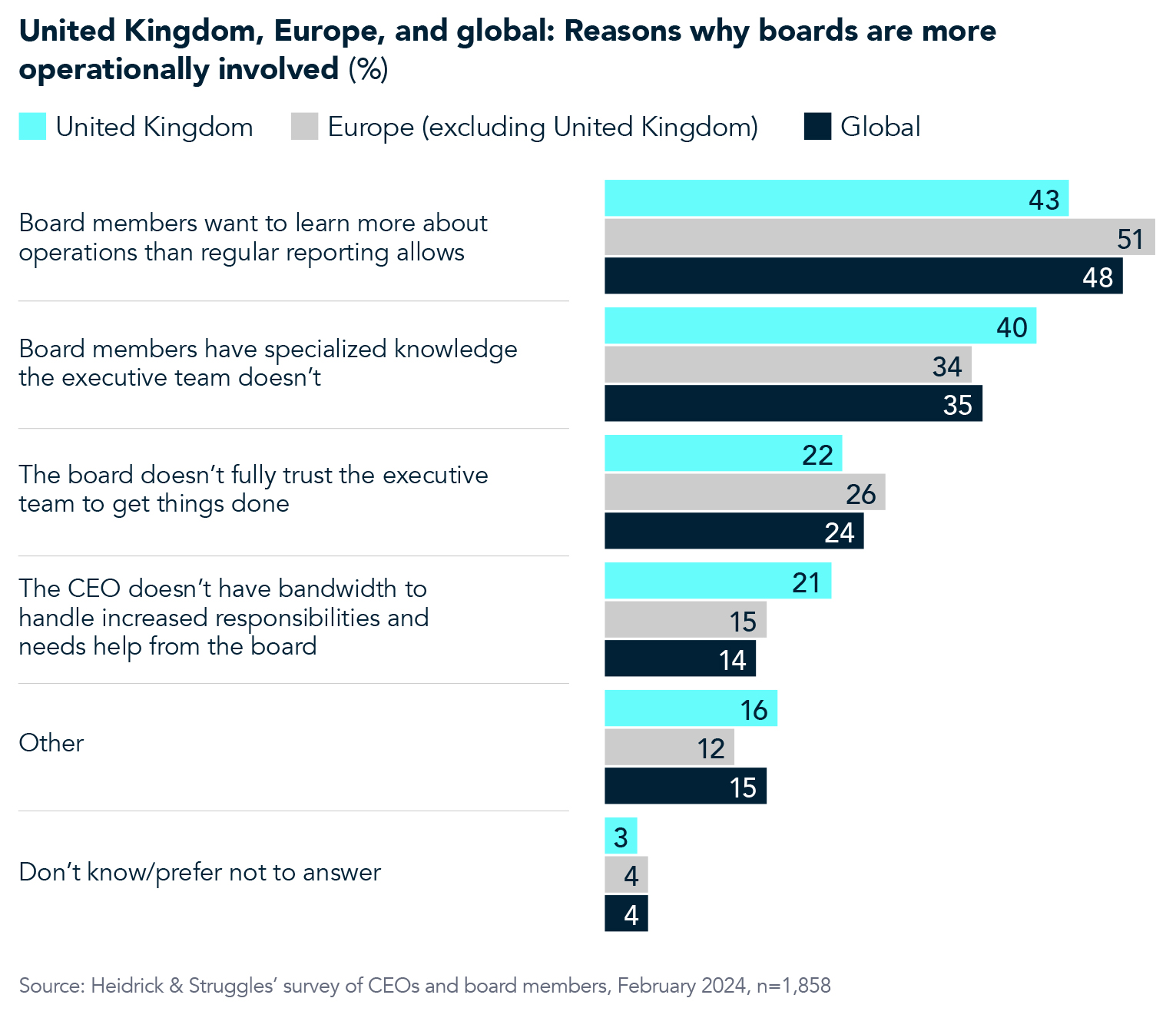

Are boards more operationally involved?

Globally, a majority of respondents report that board members are more operationally involved: 25% say it happens frequently; 45% occasionally; and 4% that it has happened once. Only a quarter report that they have not crossed that line. The figures from UK respondents are very similar, at 22%, 49%, and 2%, respectively. Notably, CEOs more often than directors report operational involvement from the board. UK respondents far more often than their global peers cite board members’ specialized knowledge and a lack of CEO bandwidth as reasons their boards have gotten involved. On the other hand, we also hear executives complain that interventions from non-executive directors lack insight, suggesting a lack of common understanding of some issues that can reduce board and executive team effectiveness.

How are boards engaging with the workforce?

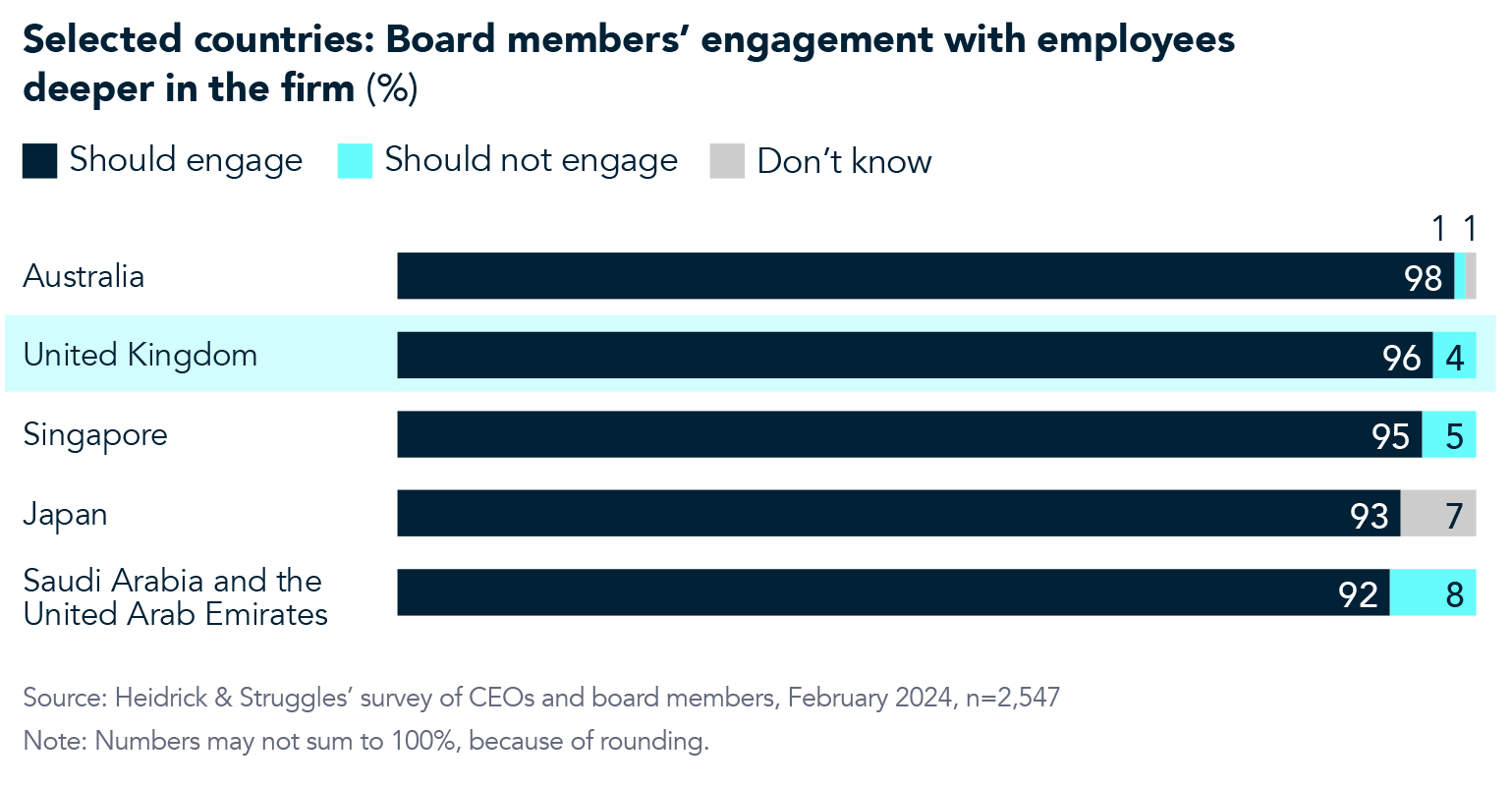

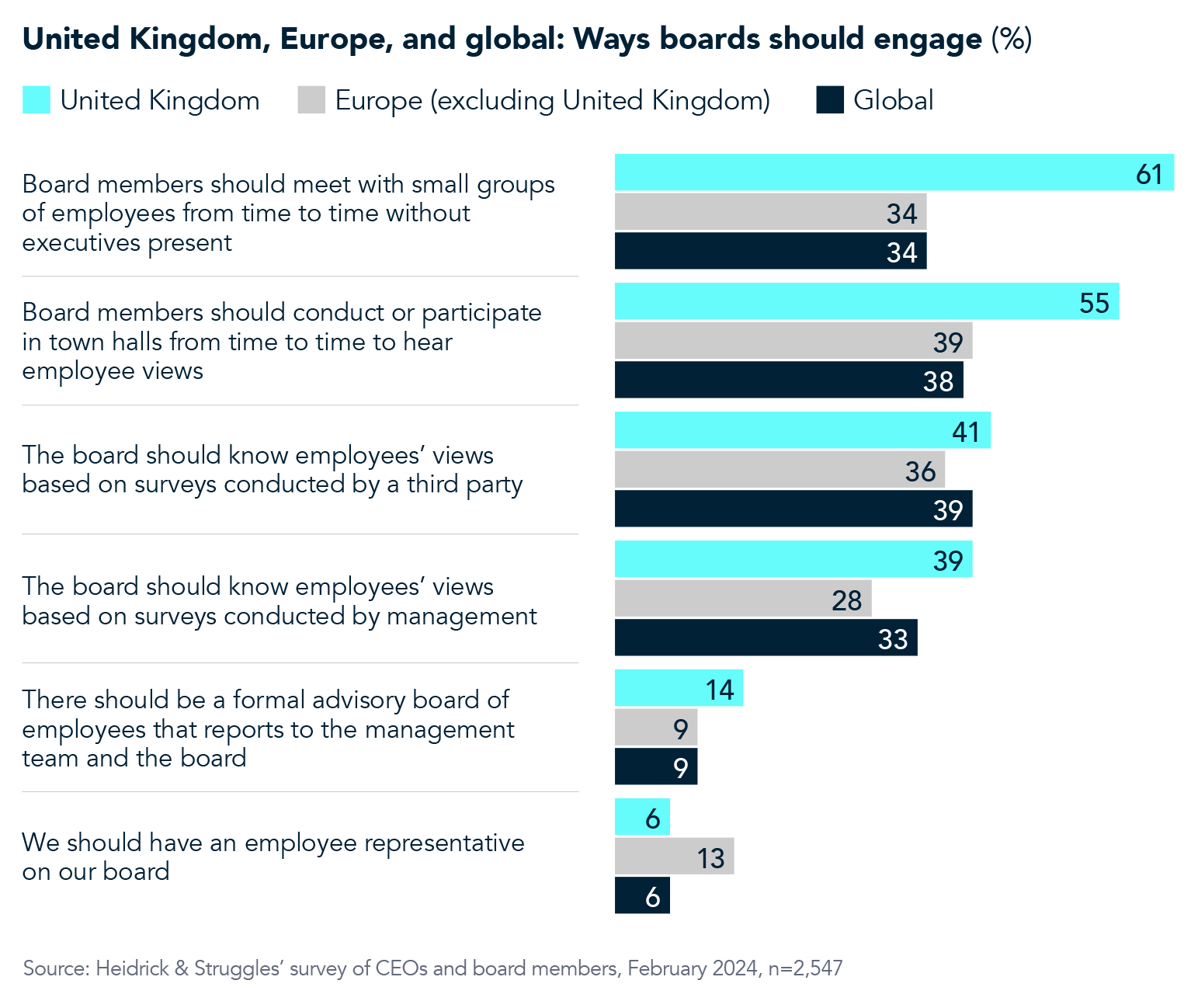

Workers are increasingly exercising their influence on the board agenda. In the United Kingdom, it is mandated that one non-executive director represent the workforce on the board of public companies. When we asked how boards should engage with the workforce, respondents in the United Kingdom were the second-highest share around the world to say that boards should engage with the workforce beyond the most senior executives.

In addition, UK survey respondents far more often than others say the board should engage in a number of different ways—though only 6% think a direct employee representative on the board is a good idea. This suggests that the mandate for a non-executive director representing the workforce may be having unintended consequences.

How are boards thinking about diversity today?

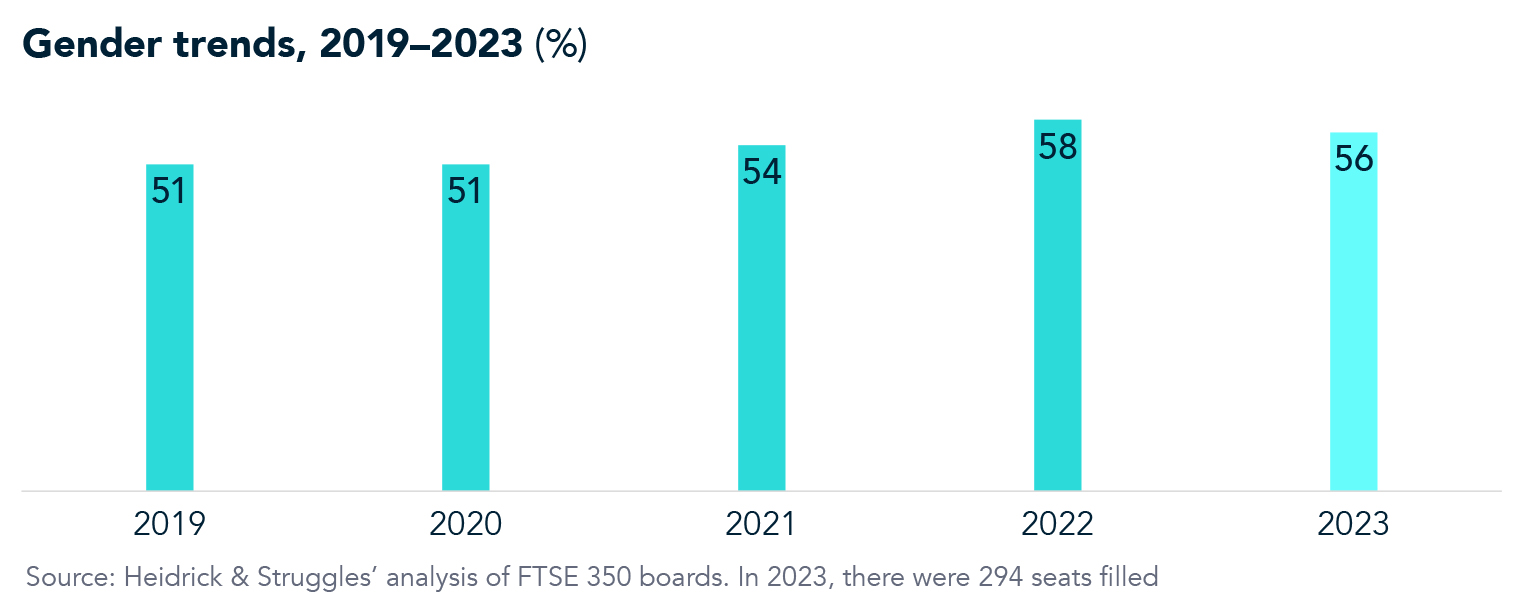

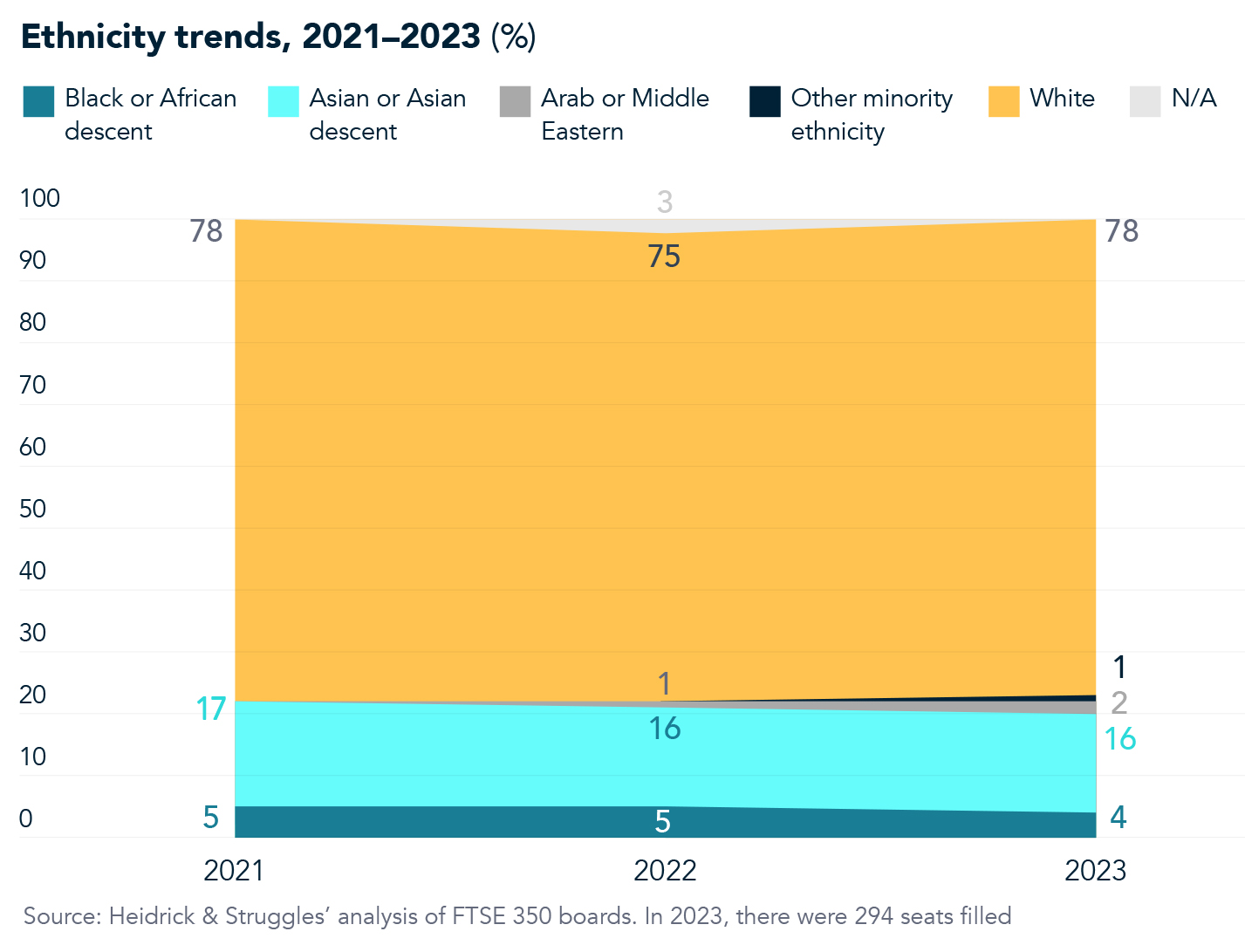

Some of the most substantial changes in the UK governance environment are reflected in the changes we see in board diversity. In the United Kingdom, we have focused on gender and ethnicity trends, which we will cover here, but the conversation has widened to consider the impact of geopolitical differences—at home and abroad, as well as the importance of other stakeholders, whose influence we covered earlier.

Our analysis of the newest class of directors added to FTSE 350 boards, and historical trends in the backgrounds of people being added to boards, is available here.

In early 2024, it was reported that the representation of women on FTSE 350 boards had increased beyond the target of 40% of directors being women by the end of 2025. Of the 350, 235 were at or above 40% and only 28 below one-third.1 The share of female directors added in the most recent year remained high, suggesting progress is continuing.

By December 31, 2024, all FTSE 350 companies are required to have at least one director of color, but progress in adding directors of non-white ethnicity has stayed roughly the same over the past three years. Still, according to the Parker Review, 96% of the FTSE 100 and 70% of the FTSE 250 have now met their target.

Recommendations

- Increase stakeholder engagement. A majority of directors are increasing engagement with stakeholders of many kinds. Engagement with the workforce varies widely by region, and from company to company. In the United Kingdom, regulators top the list of those having more influence.

- Cultivate a learning culture on the board. Directors are accustomed to being hired for their expertise—for being experts. This won’t change, but the scope of expertise required is expanding beyond the capacity of a traditional board. In this environment, “learning to learn” and business judgment have never been more important. Effective chairs set the tone for learning.

- Expand sources of expertise. Still, a growing number of boards are also using mechanisms such as advisory committees, external advisors, and on-demand talent platforms to surround the board with the range of rapidly changing skills needed to create capacity and govern in this expanding environment.

- Increase investment in succession planning. In this widening risk environment, and with rising investor pressure on directors, effective boards are adopting an ongoing approach to succession planning—for both the CEO and board itself. Reactive recruitment projects are a thing of the past. Still, our research shows concern among many directors that succession is being pushed down the priority stack and not actively addressed.

- Govern across boundaries. Polarization has reached severe levels in a growing number of countries. The new face of diversity includes and goes well beyond traditional definitions and boundaries. The implications for business are far reaching. Make certain that director candidates have the experience, wisdom, empathy, and proven reputation of working across societal and intercompany boundaries.

- Leverage others. As the scope of board responsibility expands, lean on the corporate secretary for help. Challenge service providers and outside experts to take on more, collaborate with each other, and rethink their business models (standards, pricing, conflicts). Lean on the executive team, and on peer companies, to develop collaborative insights and drive change.

Acknowledgments

Heidrick & Struggles wishes to thank the following executives for sharing their insights. Their view are personal and do not necessarily represent those of the companies they are affiliated with: Mark Cutifani, chairman, Vale Base Metals; board member, Total Energies; former CEO, Anglo American Total, Anglo American; and Sir Jan du Plessis, chair, Financial Reporting Council.

Heidrick & Struggles also wishes to thank the following colleagues for their contributions to this article: Kit Bingham, Alice Breeden, Sam Burman, Clare Buxton, Jenni Hibbert, Sherree Kendall, Will Moynahan, and Claire Skinner.

Reference

1 “FTSE Women Leaders reports,” FTSE Women Leaders.