Financial Services

Financial services focus: Leadership capabilities for the future

methodology

Heidrick & Struggles performed a global data analysis of more than 10,000 assessment results of CEOs and C-level executives across all industries, examining both self-assessments and 360-degree feedback assessments and comparing results across industries.

The data is from 2019, 2020, and 2021. Sixty-one percent of the executives assessed are based in Europe and Africa, 26% from the Americas, and 13% from Asia Pacific.

In the following charts, the data represents the share of executives assessed who are seen as having the capability or exhibiting the derailer.

Building on their current strengths, financial services leaders should focus on a few key areas of leadership development—both for themselves and for the future leaders they are developing in their institutions: learning and creating new possibilities, customer-centricity, inspiring and engaging, and self-awareness.

Our analysis of more than 10,000 assessment results of CEOs and C-level executives across industries has provided insights into how they lead, the impact they have on others, and their level of self-awareness. We based this analysis on characteristics we know accelerate organizational performance: mobilizing, executing, and transforming with agility.1

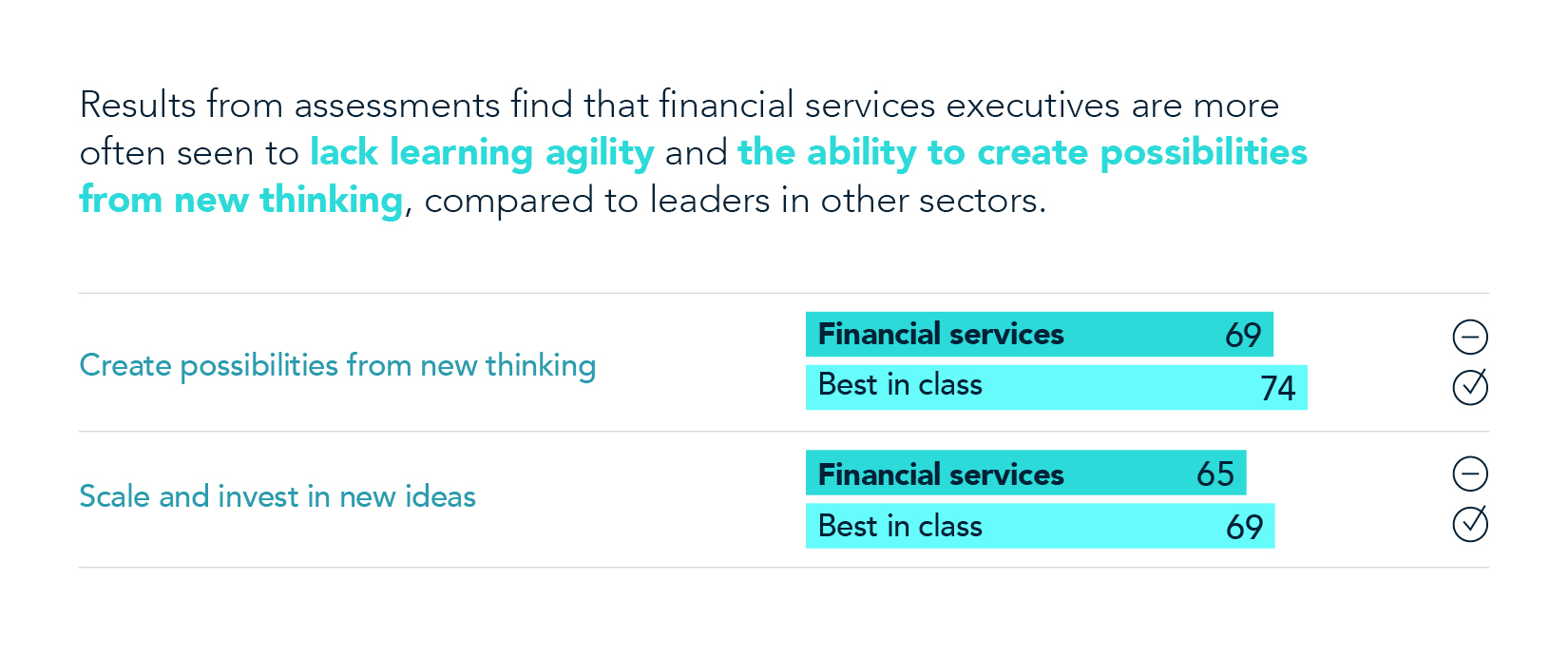

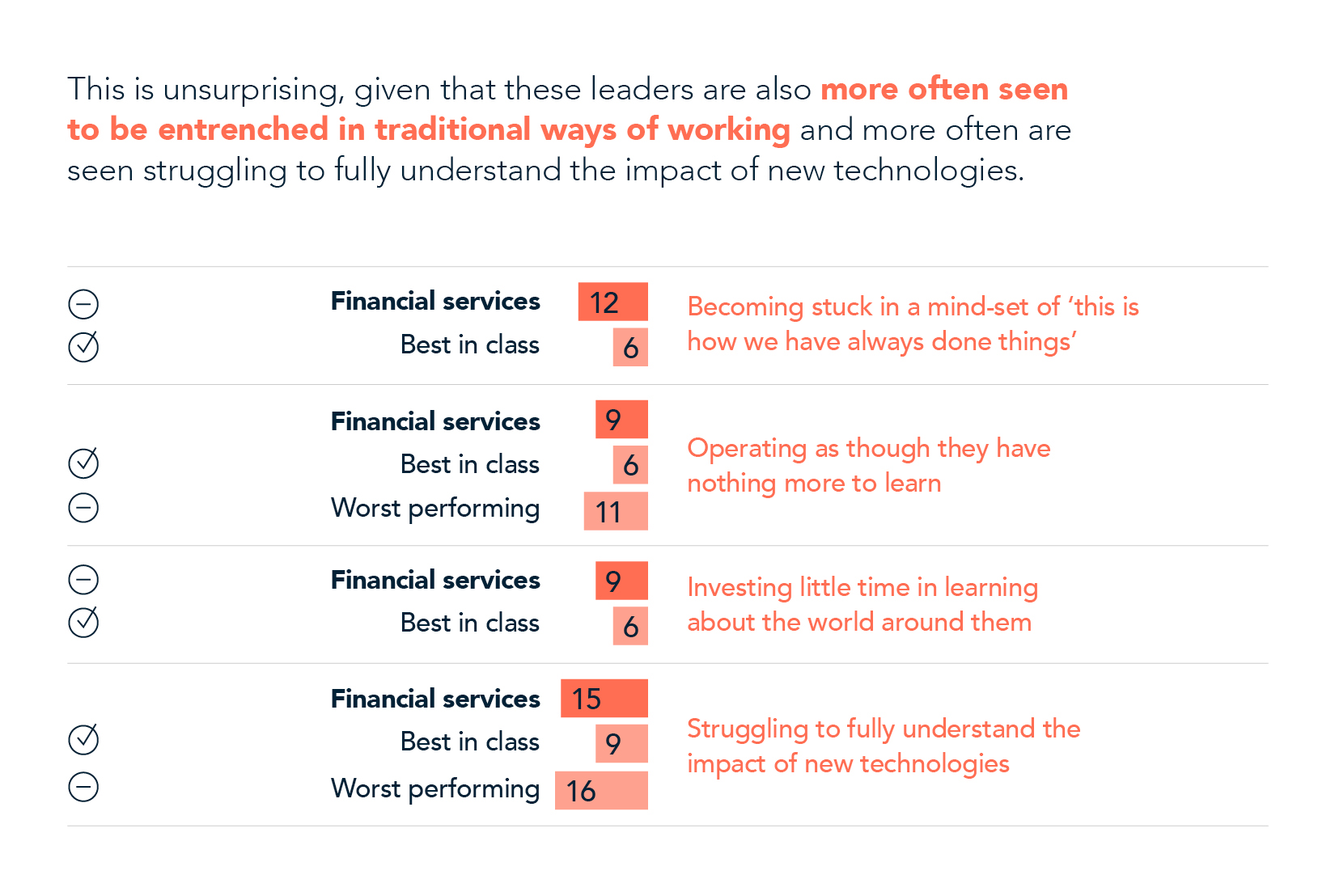

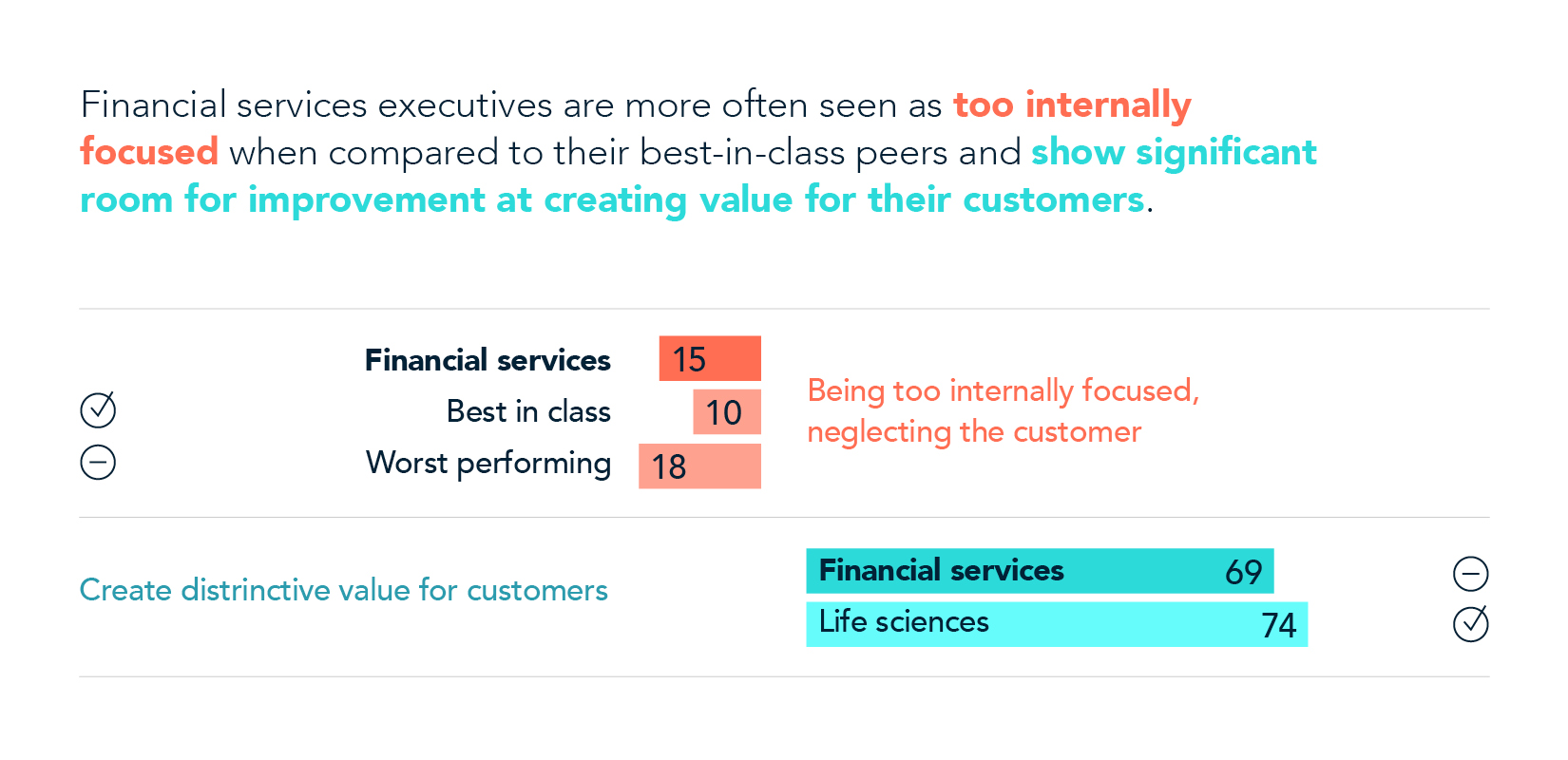

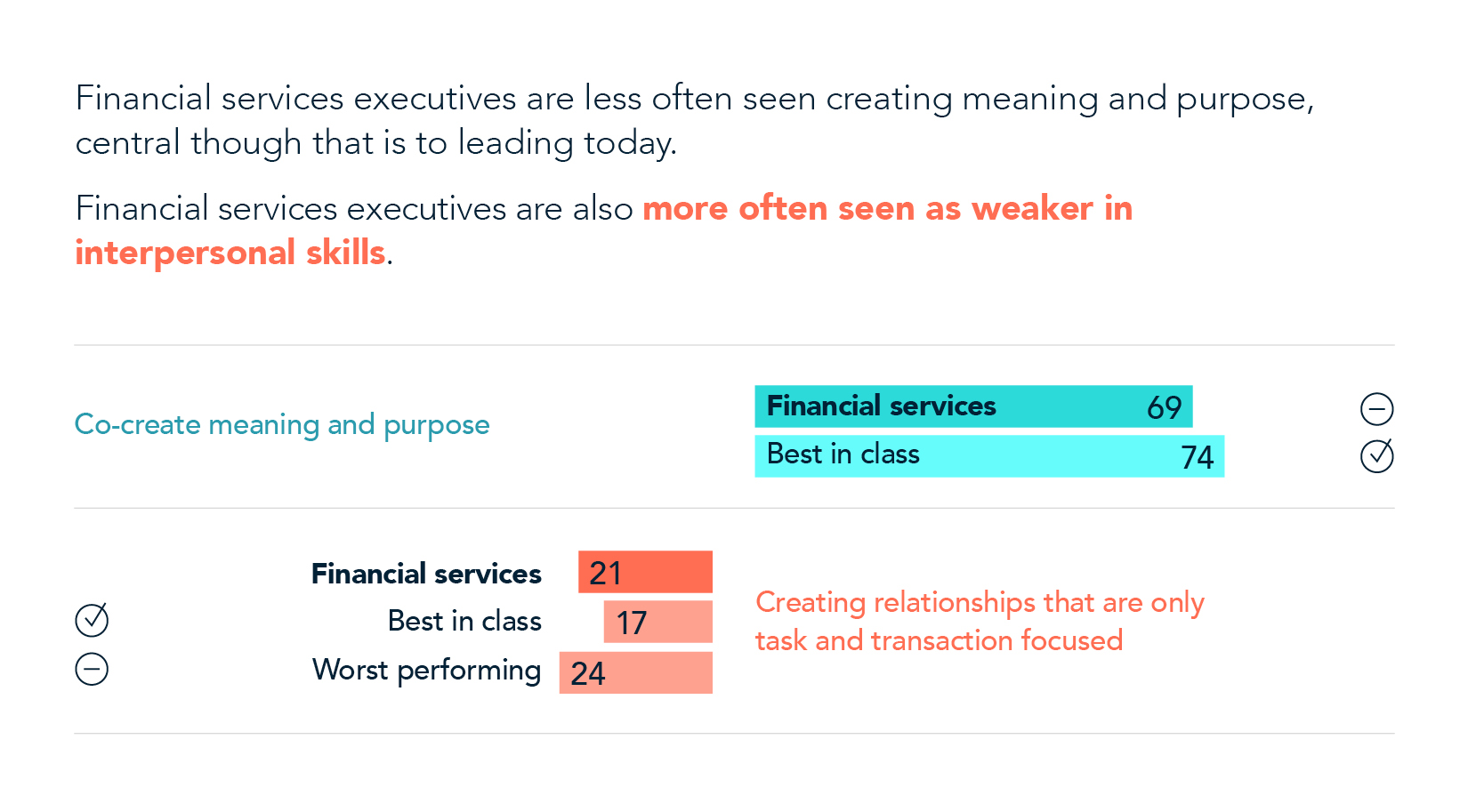

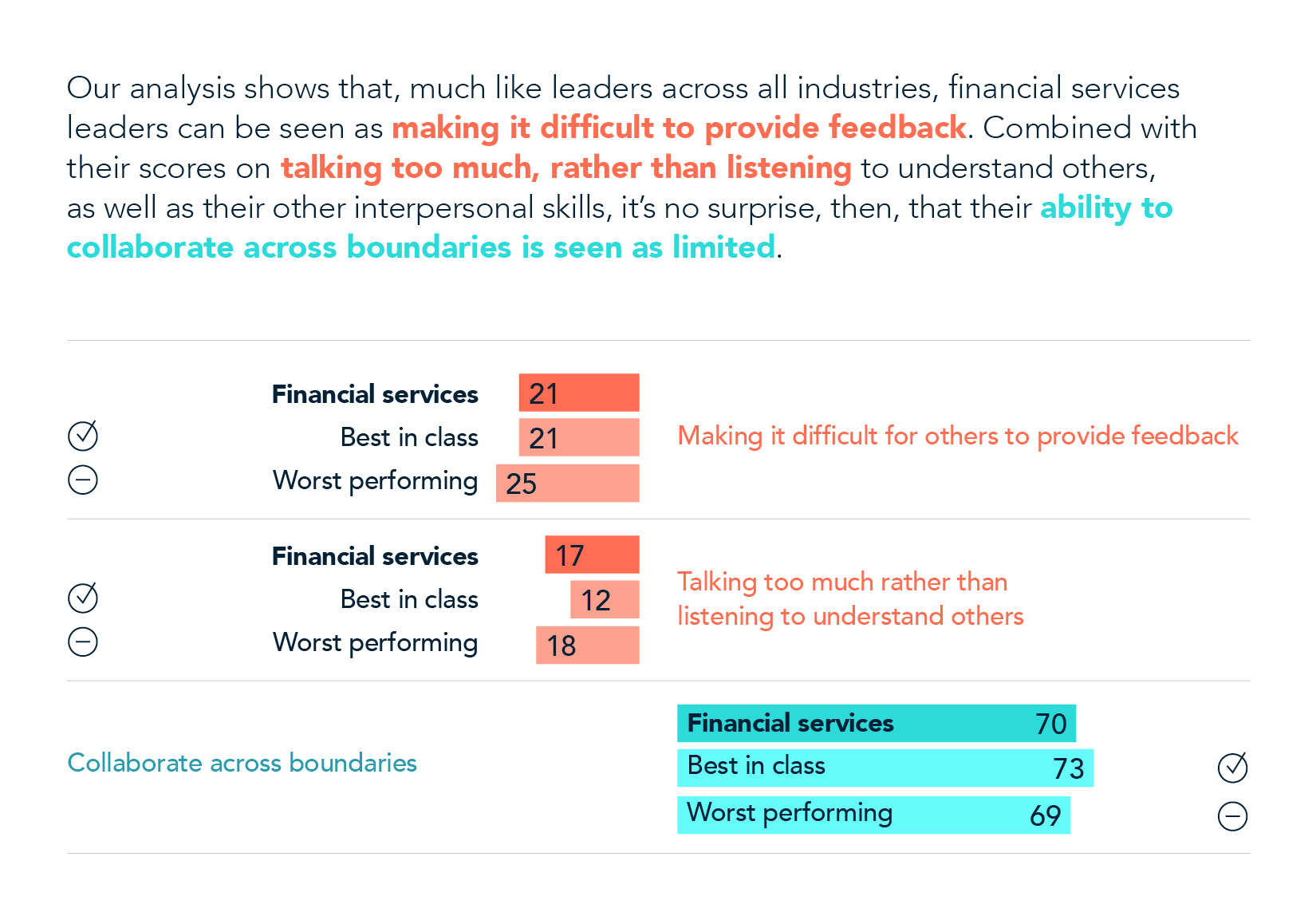

Financial services leaders, analysis shows, are seen as best in class when it comes to balancing long-term and short-term priorities, looking at underlying root causes instead of symptoms, and identifying opportunities and threats facing the business. But they have significant gaps when it comes to mobilizing, transforming, and acting with agility; these leaders are more often seen as lacking leadership capabilities such as learning and creating new possibilities, customer-centricity, inspiring and engaging, and self-awareness.

The through line is culture: a recent Heidrick & Struggles survey of 500 CEOs around the world found that how people work together, through purpose and culture, is seen as a top influence on financial performance.2 Inspirational and engaging leadership is an important way to ensure meaning, purpose, and culture all thrive, and is one leadership capability our analysis suggests financial services leaders should focus on to better mobilize their teams and organizations. The next capability is self-awareness, which will help with both mobilizing and transformation. Finally, strengthening their capabilities in learning, creating new possibilities, and being customer centric will all help executives lead through the continuous transformation the industry is facing today.

Learning and creating new possibilities

Looking ahead, with new technologies constantly emerging, cultural and working norms shifting, stakeholder expectations rising and macroeconomic parameters evolving faster than ever, best-in-class leaders will be those with a future-oriented focus and a mindset of innovation, learning, and openness to change, curiosity, and humility.

Considerations for leaders:

- How can we better cultivate a mindset of openness and curiosity in our culture and working norms?

- How can we encourage a learning mindset and a culture that fosters the boldness to try new things?

Customer-centricity

In order to rebalance their internal versus external focus, financial services leaders should consider how they can initiate a significant mindset shift toward customer-centricity. Winning financial institutions will be the ones able to navigate regulatory constraints and complex legacy IT systems, for example, to create value for customers.

Inspiring and engaging

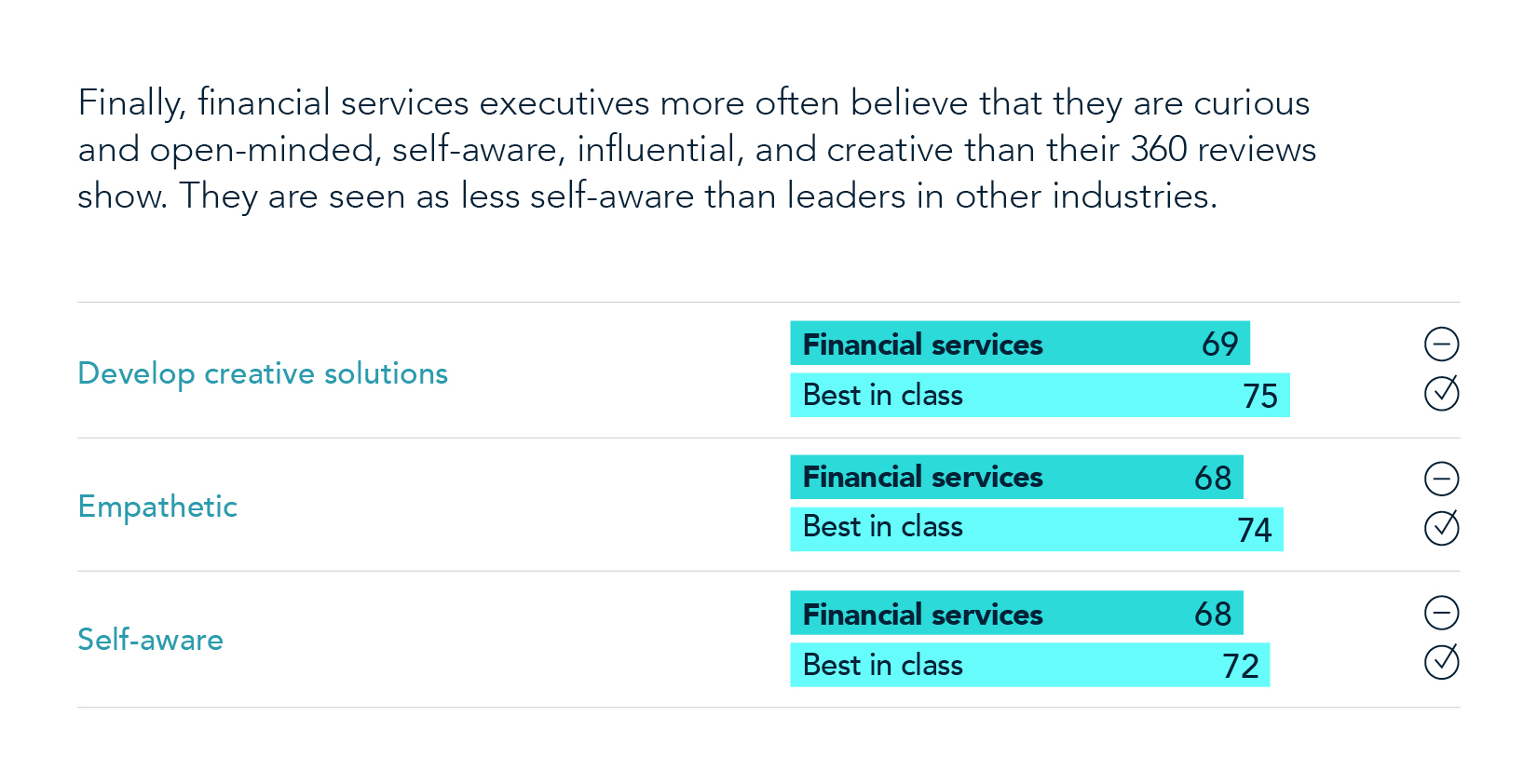

In addition, most financial services executives feel that they are empathetic, but their assessments paint a slightly different picture.All this comes together to create a sector with much progress to make when it comes to developing future leaders. Financial services leaders must be able to inspire and engage today’s teams and future leaders through shared purpose and inclusive leadership if they are to thrive.

Considerations for leaders:

- How engaging is our company purpose?

- How do we evaluate the ability of the leaders in our organization to inspire and engage the workforce?

- How can we help develop the next generation of our company’s leaders?

- How often do leaders admit mistakes in our organization?

Self-awareness

Leaders are able to excel when they know their teams and dynamics very well; they know each person’s areas of strength and areas of improvement, and how other members of their teams complement and balance those areas out. Similarly, best-in-class leaders know themselves. They are self-aware, able to sense when they are equipped to handle challenges versus when they should ask for help and how they impact others. Through their ability to understand the shadow of their leadership,3 these leaders are best able to lead through influence, inspiring and engaging all those they work with, both directly and indirectly to create thriving organizations. Best-in-class leaders are able to admit when they don’t know and when they made a mistake: they show vulnerability, humility and authenticity and through that they connect emotionally with their people and create followership.

Considerations for leaders:

- How do we make sure we create followership among our people?

- How often do we solicit feedback from our peers and teammates? How do we build on such feedback?

Managing the paradox

Historically, financial services has been a knowledge-based industry requiring the workforce at all levels to demonstrate technical skills as well as accuracy, expertise, careful analysis and discipline. These have been the core promotion principles throughout financial services organizations for generations of leaders. When it comes to balancing long-term and short-term priorities, looking at underlying root causes instead of symptoms, and identifying opportunities and threats facing the business, they are best in class. Consequently, financial services leaders tend to show high intellectual capacities as well as attention to detail. However, perhaps because of this, they are often seen as less often creating a compelling purpose and engaging the workforce through a human-centered style.

Today’s financial services leaders are required to create the financial institution of the future, leveraging digital capabilities, innovating, and focusing on customers. There is a paradox between, on the one hand, being creative, anticipating customer trends, and daring to try new things and, on the other hand, having the discipline in your organization to ensure the right controls are in place to meet technical and regulatory requirements. Leaders who will make a difference are those who can manage this paradox skillfully.

Managing the paradox requires a growth mindset.4 Best-in-class leaders build purpose-driven organizations, focus on customers and have a human-centered leadership style. These are able to lead their organizations into the future, attracting and retaining the talent they need and releasing their teams’ discretionary energy. Last but not least, these leaders positively impact financial performance.

About the authors

François-Xavier Ragot (fxragot@heidrick.com) is a principal in Heidrick & Struggles’ Paris and Brussels offices and a member of the Financial Services Practice.

Sharon Sands (ssands@heidrick.com) is a partner in the London office and leads the Leadership Development, Leadership Assessment, and Executive Coaching practices as part of the Heidrick Consulting global leadership team. She is also a member of the Financial Services Practice.

References

1 The characteristics we know accelerate organizational performance are mobilizing, executing, and transforming with agility, or META. At a high level, organizations that succeed across all the aspects of META are able to adapt and pivot faster than competitors in areas where doing so adds value—critical capabilities in an ever-changing world. For more, see TA Mitchell, Sharon Sands, and Naomi Record, “Developing future-ready leaders,” Heidrick & Struggles, heidrick.com.

2 See “Aligning culture with the bottom line,” Heidrick & Struggles.

3 Purpose-driven leaders who are intentionally committed to the organization and its culture cast a long shadow of positive influence. For more on the shadow of the leader, see Anne Comer, Priya Dixit Vyas, Rose Gailey, Jenni Hibbert, Adam Howe, Ian Johnston, John McKay, Holly McLeod, and Dustin Seale, “Special feature: The pillars of culture shaping,” Heidrick & Struggles.

4 For more on cultivating a growth mindset, see Cynthia Emrich, Steven Krupp, and Amy Miller, “Developing future-ready leaders: From assessments to strategically aligned learning,” Heidrick & Struggles, heidrick.com; and Alex Libson, TA Mitchell, and Mark Watt, “Making leadership development a team sport,” Heidrick & Struggles.