Sustainability & Climate

Changing the Climate in the Boardroom

Executive summary

In the months preceding the United Nations’ Climate Change Conference, COP26, which took place October 31–November 12, 2021, the INSEAD Corporate Governance Centre and Heidrick & Struggles conducted a global survey of board directors. Our goal was to investigate how boards understand and are coping with the process of decarbonization and how far climate change has been integrated into their oversight responsibilities. In publishing the findings summarized below, we aim to provide fact-based, honest, and practical support for directors and their companies on the journey toward net zero.

Overall, the results of our survey revealed a clear disconnect between what board members say about the importance of climate change to their companies and what the boards actually do.

Reasons for optimism

Climate change is now a firm fixture on board agendas.

Reasons for concern

However, when we asked about specific measures for addressing climate change, the outlook was less rosy.

These results are not necessarily incompatible with the figures that give us cause for optimism. However, drilling down further, we found results that ring larger alarm bells.

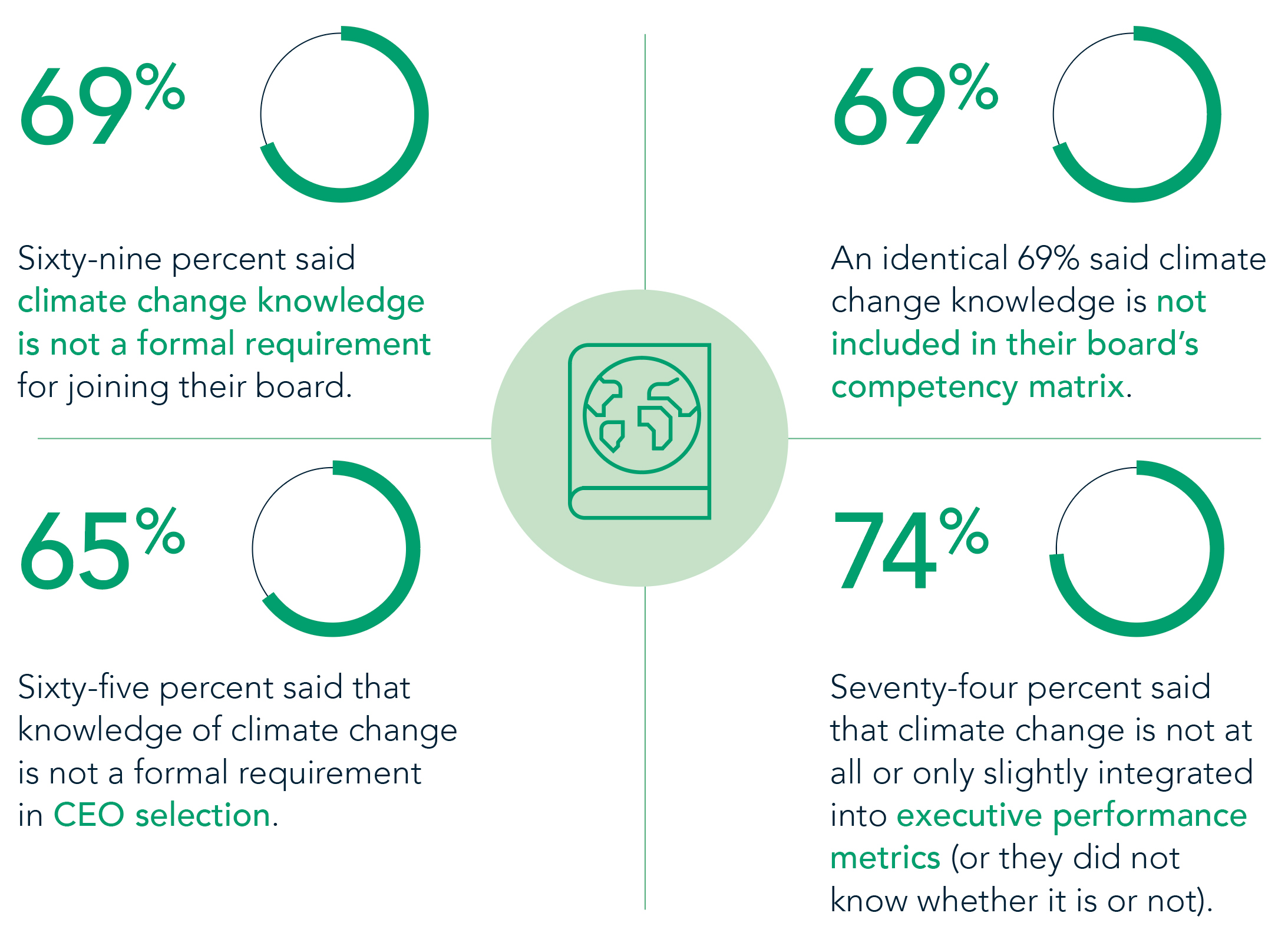

Furthermore, knowledge isn’t prioritized.

A superficial interpretation of our findings could be that many boards are only paying lip service to climate change. However, it is far more likely that many directors are overwhelmed by the scale and complexity of their environmental, social, and governance (ESG) responsibilities. The interpretation that we feel may be most compelling is that most boards are caught in a vicious circle. Put simply:

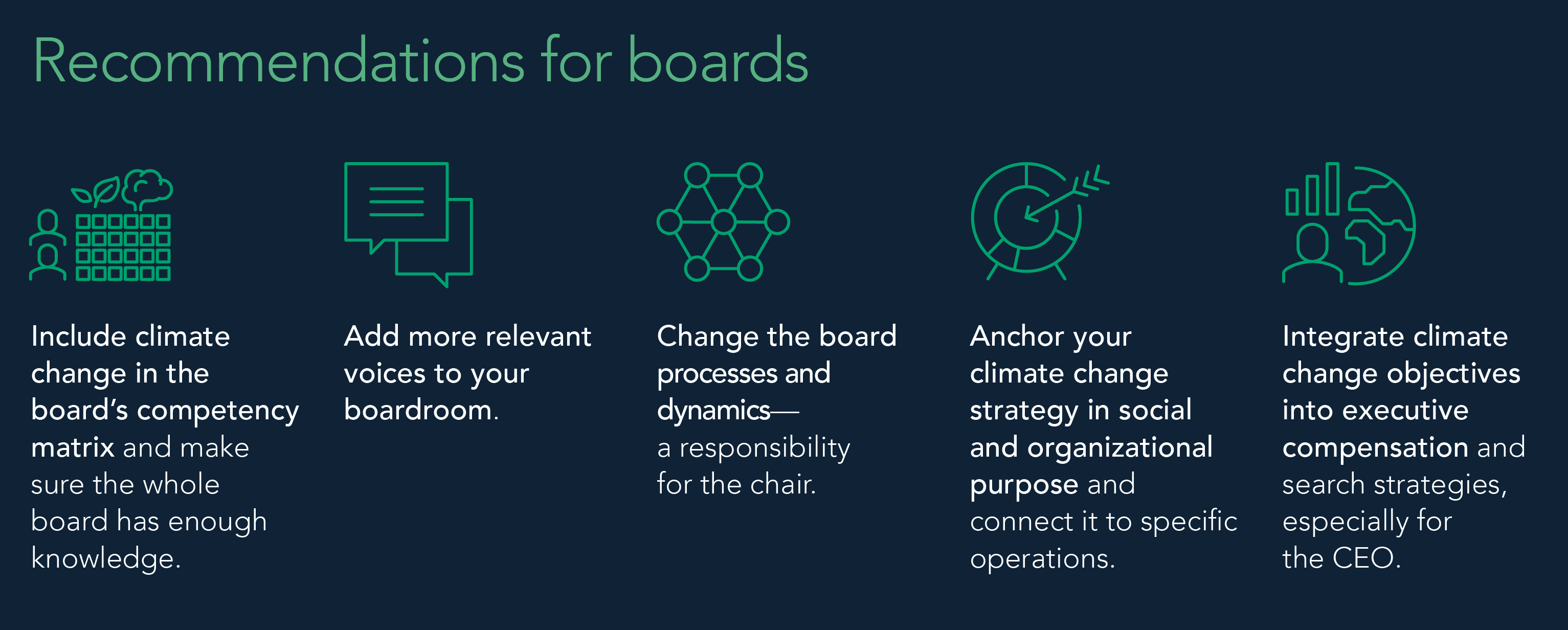

We conclude this report by offering some ideas based on successful, real-life practice about how to fill the knowledge gaps and break the vicious circle.

Contact Information

Louis Besland (lbesland@heidrick.com) is a partner in Heidrick & Struggles’ London and Paris offices and a member of the CEO & Board of Directors and Industrial practices; he leads the chemicals sector for Africa, Europe, and the United Kingdom.

Alice Breeden (abreeden@heidrick.com) is the leader of CEO & Board and Team Acceleration for Heidrick Consulting; she is based in Heidrick & Struggles’ London office.

Jeremy C. Hanson (jhanson@heidrick.com) is a partner in Heidrick & Struggles’ Chicago office and a member of the CEO & Board of Directors Practice, from which he consults on the governance and leadership implications of growing investor demand for sustainability (ESG) performance.

Ron Soonieus (ron.soonieus@insead.edu) is Director in Residence at the INSEAD Corporate Governance Centre.

Sonia Tatar (sonia.tatar@insead.edu) is the Executive Director of the INSEAD Corporate Governance Centre.

The INSEAD Corporate Governance Centre can be reached at: corporate.governance@insead.edu

Acknowledgments

The authors wish to thank Monica de Virgiliis, board chair, Chapter Zero France; the INSEAD Corporate Governance Centre team; and the Heidrick & Struggles team for their contributions to this report. They also wish to extend thanks to all those who responded to the survey and contributed to the realization of this study.