Leadership Succession Planning

CEO and board confidence monitor 2025: Persistent concerns, pockets of increased confidence

Continued low confidence in managing what matters most—but progress on some issues

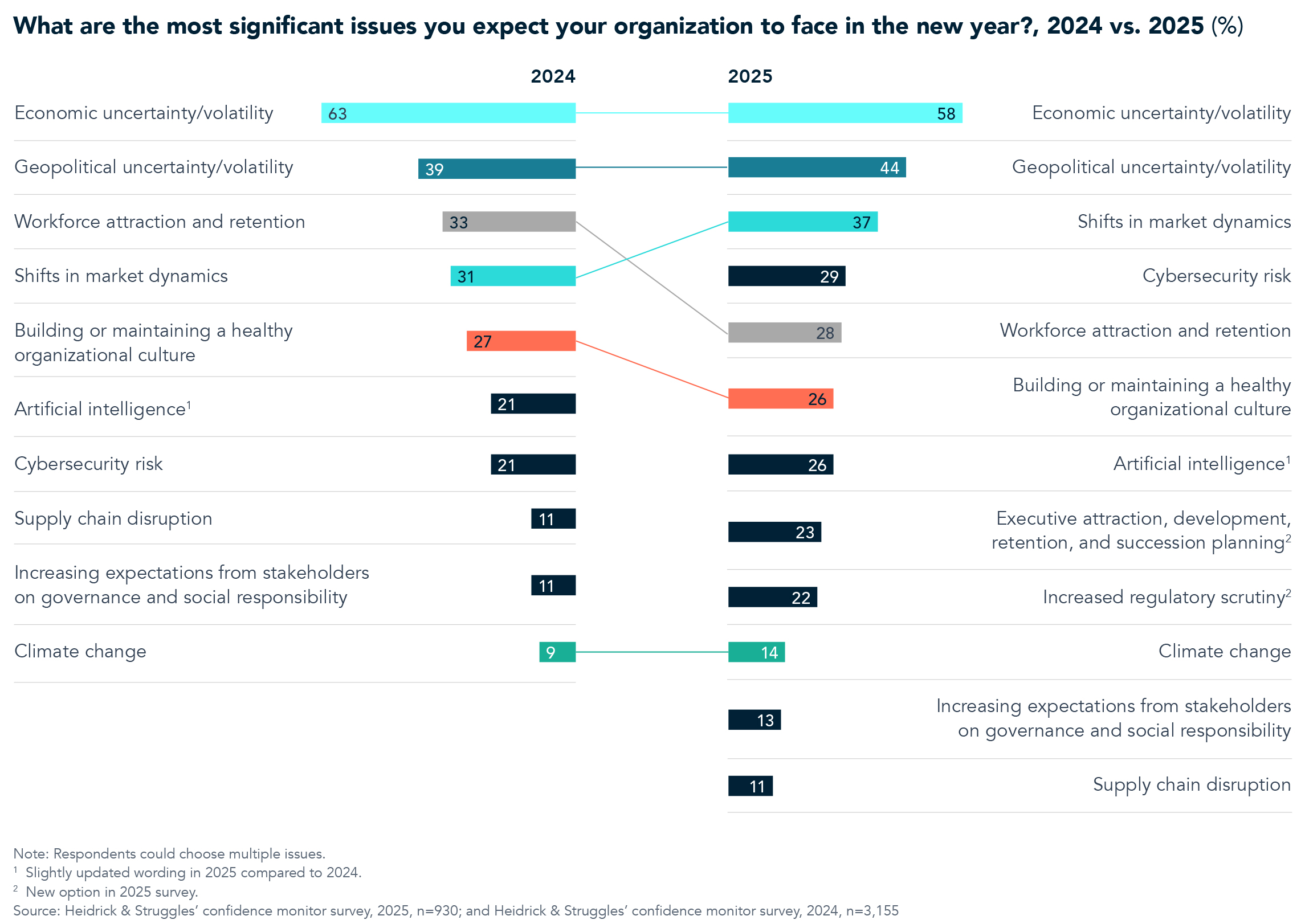

The issues CEOs and board members say will be most significant in 2025 are similar to those they identified last year, and CEOs and board members are generally aligned on what’s important.

On the whole, leaders’ confidence in their organization’s ability to manage the issues that matter most to their organizations has changed little since last year. In addition, the issues that the highest shares of directors find significant remain among those they have the least confidence in managing. Regarding economic uncertainty and volatility, an even smaller share of leaders are confident compared to last year.

- Leaders in the technology sector are notably more often confident than others in their ability to manage cybersecurity risk, at 75%. And leaders in financial services are most often confident in their ability to manage shifts in market dynamics, at 68%, perhaps a function of their relative and historical strength in crisis management, building risk management frameworks, and being on the front lines of regulatory pressure.

- Leaders in the United States and Canada are most confident in their ability to manage increasing expectations from shareholders, at 85%, and those in Asia Pacific and the Middle East least confident, at 45%.

However, leaders do indicate notably greater confidence in their organization’s ability to manage a few issues, including supply chain disruption, workforce attraction and retention, cybersecurity risk, increasing stakeholder expectations, and climate change.

Looking at the combination of significance and confidence in managing, the top issue is cybersecurity risk. Two other concerns are relatively significant, and leaders are relatively confident in managing them: workforce attraction and retention and building or maintaining a healthy organizational culture.

Despite their generally low levels of confidence in managing the most pressing issues, nearly two-thirds of leaders remain confident in the ability of their organization to deliver on its 2025 strategic plan—again, about the same as last year.

- Leaders in the United States and Canada are much more confident in their organization’s ability to deliver on the plan than respondents in other regions (71%, compared to a range of 49–58% of respondents in other regions). This is likely related at least in part to their greater confidence in their leadership pipelines.

Continued concern about leadership pipelines

Leaders’ continued notably low levels of confidence in their executive pipeline, CEO succession planning, and board refreshment practices1 indicate that companies still need to continue to increase their focus on long-term topics even when other considerations have higher immediate significance. In this context, it’s good news that 52% of CEOs and directors said their company is increasing its investment in CEO and board succession planning in a survey we conducted earlier this year.2

- Leaders in the United States and Canada are more confident than their peers in other regions in all three of these areas. Nonetheless, on CEO succession planning, even they are evenly split: 50% are confident and 49% are not.

Considerations for 2025

- CEO succession is one of the most fundamental responsibilities of the board. Yet repeated studies, including our own, demonstrate that it remains low both in the board’s priority stack and in the priority they put on it to address. In our recent study, directors also report relatively low satisfaction with their CEO succession planning and board refreshment processes. There are notable differences based on company size and industry sector, but overall investment remains stubbornly low. Directors will benefit from a closer look at why, which we have explored elsewhere.3

- Other research we have conducted suggests two tactics to improve the executive pipeline: extending succession planning far deeper into the organization than it currently goes at most companies and building stronger links between leadership development, promotion, and succession planning efforts.

- Over time, we have seen leaders’ confidence grow in their companies’ ability to manage complex issues from cybersecurity to climate change, issues that were at first sources of serious concern and confusion.4 Moving from uncertainty to confidence is important when a lack of knowledge contributes to highly divergent opinions on how to act. An organization’s ability to work effectively across intransigent divides is becoming increasingly important in today’s polarized geopolitical climate. CEOs and directors in the United States are grappling with this now, given the difficult political climate. What they are learning may ultimately build confidence on this difficult area of concern.5

About the research

In November 2024, Heidrick & Struggles fielded an online survey that garnered 930 respondents. Of those, 64% were CEOs and 36% were directors. Forty-nine percent were in Europe; 28% in North America; 14% in Asia Pacific; 5% in Latin America; 4% in the Middle East; and 1% in Africa. Respondents represented companies of all sizes; 30% reported annual revenue of more than US $1 billion. Companies ranged across all industries and ownership structures.

References

1 Though the numbers show minimal improvement, none of the changes are statistically significant.

2 For more, see Jeremy Hanson, “CEO and board confidence monitor: Beating the succession planning paradox,” Heidrick & Struggles, October 30, 2024.

3 For more, see Jeremy Hanson, “CEO and board confidence monitor: Beating the succession planning paradox,” Heidrick & Struggles, October 30, 2024.

4 For more on how boards are managing climate change, sustainability, and geopolitical volatility, see Jeremy Hanson, Claire Skinner, Ron Soonieus, Sonia Tatar, and David Young, Boards and Society: How Boards Are Evolving to Meet Challenges From Sustainability to Geopolitical Volatility, Heidrick & Struggles, November 18, 2024.

5 For more on what we have learned recently about how leaders in the United States think about leading across boundaries and divides, see Jeremy Hanson and Jonathan McBride, “Leading across boundaries and divides,” November 8, 2024.